Blog | 06 Dec 2023

Can we walk the talk as we approach our 2030 climate goals?

Ruchira Ray

Lead Economist, Climate & Sustainability

As the world heats up, so does the urgency to assess our collective progress against the goal of limiting global temperature increases to 2℃ as set out in the Paris Agreement.

The UN Climate Change’s stocktake report formed a key discussion point at the at the 28th Conference of the Parties (COP28) in Dubai. The report offered a sobering reality check and suggests a step change is necessary on all fronts.

This report puts the cards on the table – except this is not a game. We know that we as the global community are not on track towards achieving the long-term goals of the Paris Agreement and that there is a rapidly closing window of opportunity to secure a livable and sustainable future.

Simon Stiell, Executive Secretary of UN Climate Change

Despite progress on climate change mitigation, the world is not moving fast enough to meet the Paris Agreement goals. Rapid transformation and systemic changes are required across all industries and sectors. Low-emission technologies need to be scaled up, while phasing out high-emitting ones and ending deforestation. The report also highlights the slow pace of action on adaptation, particularly in developing countries on the front line of climate change impacts, where capacity building of skills, process, and resources is crucial.

Developed economies will need to lead the way by raising mitigation goals and ensuring rapid transformation of energy systems. Developing economies will need to find ways to develop sustainably, without falling into a high-carbon trap while adopting adaptation measures in the short run and building capacity for the long run.

Regardless, there are transition risks considering the scale of change economies must enact in a short space of time. However, importantly, the longer we wait to implement climate change mitigation strategies, the more disruptive the risks become.

To learn more about the findings of the Global Stocktake and its implications, you can view the full research briefing here.

Australia’s journey towards net zero

Australia has made significant strides in our commitments to emissions reduction over the last 18 months. We have legislated reaching net zero by 2050, with further ambitions to reduce our greenhouse gas emissions by 43% by 2030 from 2005 levels.

What’s more, the 2023 Climate Change Statement projects that Australia is on track to reach 42% reduction by 2030, falling only a touch short of the 43% target.

Can we walk the talk?

Talking about the implementation of ambitious programs and projections of success is important, but can we walk the talk? When you look beneath the hood of our emission reduction trajectory you find that our success to date is mixed.

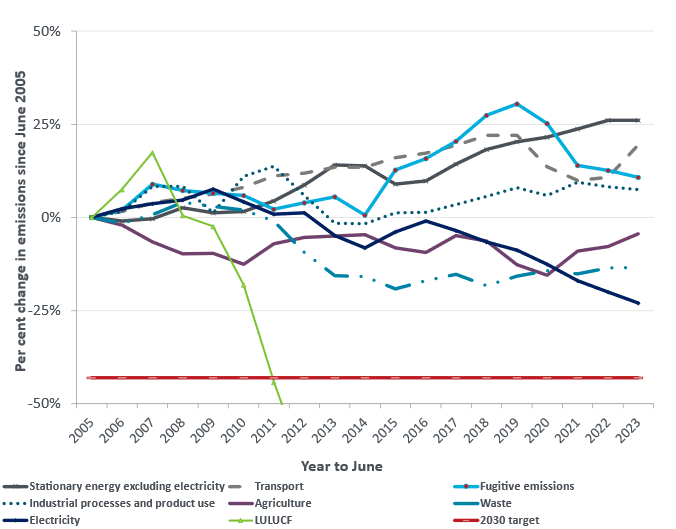

The chart below describes how each emission contributing category is tracking towards our 2030 target of reducing emissions by 43% compared to 2005. Land use, land use change and forestry (LULUCF) has been the main driver of Australia’s aggregate fall in emissions to date. Notably, this driver is disconnected from the majority of the economy and people’s everyday life.

Chart of Australia’s emissions to date and forecast

Note: LULUCF is observed to be -179.1% below 2005 levels in 2023.

The real good news story is the way that emissions from electricity generation has been steadily falling since 2016 as rooftop solar, energy efficiency measures and a shift towards a green grid is reducing our need for fossil fuel generated electricity. In line with this, Government has doubled down with the recently announced Capacity Investment Scheme (CIS), promising to underwrite 23GW of renewable energy projects.

But that’s where the good news ends. While waste and agriculture based emissions are both lower now than their 2015 levels – neither of these measures are tracking towards further emissions in the near term.

Furthermore, there’s a lot of work to be done on fugitive emissions, industrial processes and stationary energy production. The Safeguard Mechanism is designed to address the challenge here – but there’s a lot of work to do.

Finally, the reduction in transport emissions in recent years looked good – but it’s now becoming apparent that this was a result of movement restrictions during COVID rather than effective climate change behaviour. As a matter of fact, transport emissions are moving quickly towards new highs with the sale of heavy emitting SUVs combined with very rapid population growth. Again, we’re talking about the introduction of vehicle emission regulation – but there’s a long way to go before we’ve reduced our emissions from this source by 43%.

Your Author

Ruchira Ray

Lead Economist, Climate & Sustainability

Ruchira Ray

Lead Economist, Climate & Sustainability

Sydney, Australia

Ruchira joined Oxford Economics Austalia in 2019, in macroeconomic consulting. Ruchira has worked on several buy side and sell side Due Diligence projects for assets spanning energy, transport, and real-estate. Additionally, Ruchira leads our climate change consulting team in Australasia.Ruchira also has experience in the energy sector, working on several gas and electricity outlook reports for the Australian Energy Market Operator (AEMO), leading the development of industrial sector demand forecasts including regularly interviewing energy intensive industrial users of gas and electricity; producing retail gas price forecasts and conducting scenario setting consultation with industry.Ruchira is also well versed with operating our Global Economic Model (GEM) to produce scenario forecasts.

Our work

Case Study | Australian Energy Market Operator

Oxford Economics Australia and AEMO’s 2022-23 Energy Outlook Collaboration

Project background The Australian Energy Market Operator (AEMO) engaged Oxford Economics Australia (OEA) to develop economic and demographic scenario forecasts for their 2022-23 energy outlook reports. AEMO, responsible for Australia-wide planning and forecasting publications, required these forecasts as inputs into their modelling processes. The scenarios, outlined in AEMO’s Inputs, Assumptions and Scenarios Report, were developed…

Find Out More

Case Study | Australian Energy Market Operator

Review and validation of AEMO’s cost of capital assumptions for renewable energy investments

Project background The Australian Energy Market Operator (AEMO) engaged Oxford Economics Australia (OEA) to review their cost of capital assumptions for long-term investments in the National Electricity Market (NEM). The review aimed to assess the impact of asset-specific and market risks on the cost of capital. The cost of capital assumptions are key to developing…

Find Out More