Blog | 08 Jan 2024

Australia’s Safeguard Mechanism to complement CBAM

Ruchira Ray

Lead Economist, Climate & Sustainability

What is the Carbon Border Adjustment Mechanism (CBAM)?

The Carbon Border Adjustment Mechanism (CBAM) is a policy instrument introduced by the European Union (EU) to combat carbon leakage.

Carbon leakage occurs when production is redirected from a country with a price on carbon to a country with no or negligible price on carbon. As a result, the emissions in one country may go down but at the expense of another.

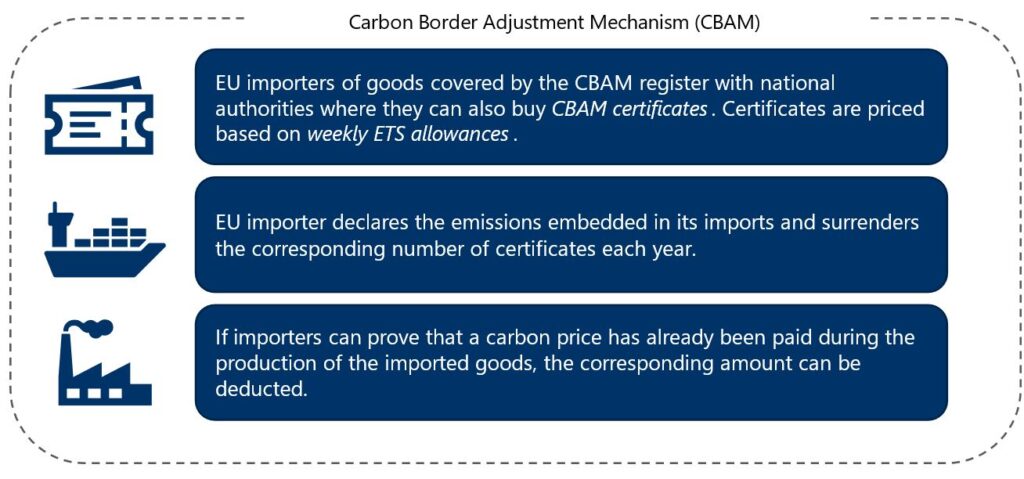

Under the CBAM, importers to EU will be required to surrender CBAM certificates for their declared emissions.

Fig 1: CBAM Implementation

Source: Oxford Economics / European Union

In October 2023, the CBAM entered its first transitional phase, requiring EU importers to start reporting on their emissions. The CBAM will come into full force in 2026, when importers will be required to purchase and surrender CBAM certificates.

Initially, the CBAM will only apply to Aluminium, Fertilisers, Iron and Steel, Hydrogen and Electricity sector imports, which are the most emissions-intensive sectors. From there, the scope will increase until all import products are covered under CBAM by 2034.

How will this shape European Trade?

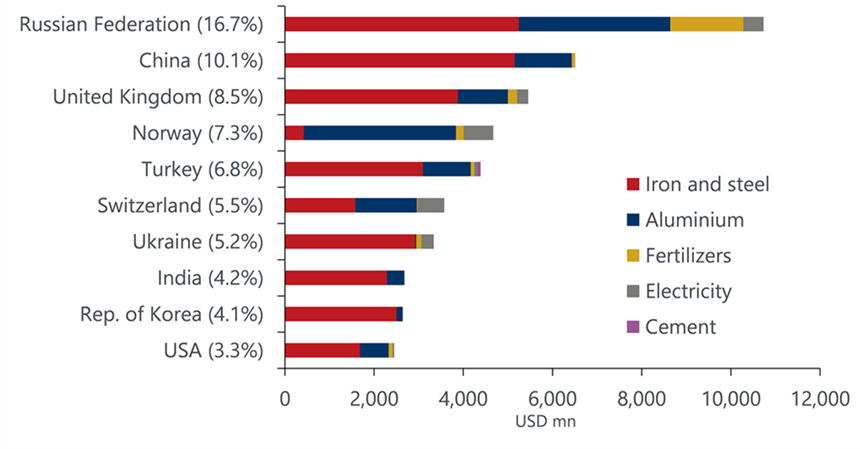

Our analysis suggests that CBAM will have a negligible impact on the EU, largely due to the narrow scope and low price of the border tariff, and the fact that many CBAM items are already traded within the EU.

Interestingly, some of the trading partners who export the most CBAM products to the EU are exempt as they either have their own carbon price (like the UK) or are part of the EU ETS (like Norway). Elsewhere, CBAM items represent a small share of a country’s overall export basket. The more significant effects might be felt at a micro level, where companies engaged in cross-border imports and exports of CBAM goods will bear an additional administrative burden and might have to adjust the way they do business.

Fig 2: Countries that export the most CBAM products to the EU-27 Source: Oxford Economics

Source: Oxford Economics

For more on our analysis of CBAM and its implications for trade, you can read our research briefing here.

What implications does this have for Australia and what role will the Safeguard Mechanism play?

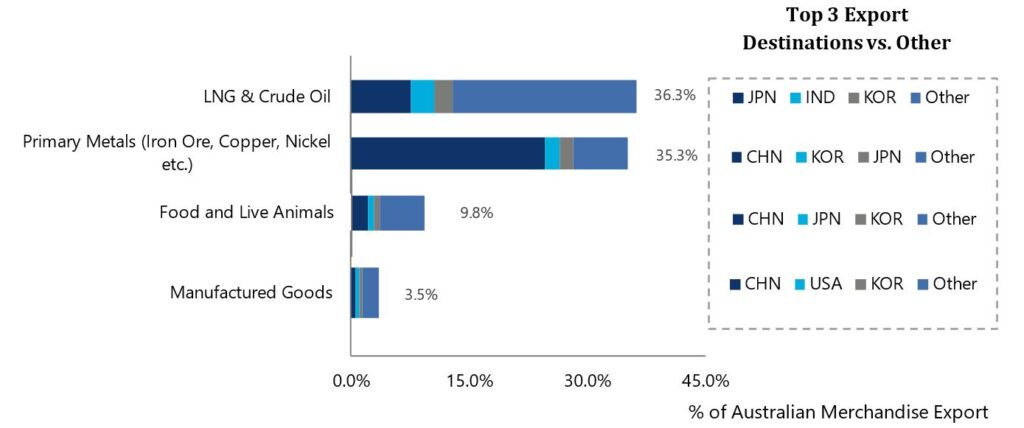

CBAM is unlikely to have a material direct impact on Australia. Only 4% of Australian exports are destined for Europe. We are much more reliant on Asia for trade with China, Korea, India and Japan amongst our biggest export destinations for merchandise trade, as shown.

Fig 3: Merchandise Trade by Commodity Group (YTD, October 2023)

Source: Oxford Economics / Haver Analytics

Even as the scope of CBAM broadens, we expect Australian industries to remain relatively insulated. Australia is already pursuing its own emissions mitigation scheme with the implementation of the Safeguard Mechanism which is likely to exempt Australian industries from requiring CBAM certificates.

Australia is one of the few nations that has taken a targeted industry approach to its emissions mitigation policy. This Safeguard Mechanism has been designed to first cap and then gradually reduce the emissions of the most emissions-intensive sectors. These emissions caps are determined at the industry sector level.

Australia’s Safeguard Mechanism (2016 & 2023)

The Safeguard Mechanism was first introduced in 2016 and places a limit on the emissions from Australia’s largest polluters. This policy covers just over 200 industrial facilities, encompassing sectors such as mining, manufacturing and waste processing.

The Safeguard Mechanism scheme sets baseline emissions caps, by sector. Facilities that exceed these emissions baselines are required to acquire and surrender Australian Carbon Credit Certificate (ACCUs). To incentivize emissions reductions, the cap is reduced overtime.

In order to meet the more ambitions targets of reaching net zero emission by 2050, the Safeguard Mechanism scheme was reformed in July 2023. More stringent forward-looking emissions caps have now been introduced.

For our view on the economic implications of the Safeguard Mechanism, you can read the research briefing here.

Nevertheless, there are lessons to be learnt from CBAM for Australia, as the European Union sets a precedent for tackling the issue of protecting the trade competitiveness of local industries while setting the right incentives for transition to a low-emissions economy.

Australia has begun its own review into carbon leakages, with the outcomes of the review expected by late 2024. This will form the foundation for any future policy around protecting the competitiveness of Australia’s own industries.

Undoubtedly, how the CBAM evolves will provide useful insights to Australian industries and policymakers alike.

Your Author

Ruchira Ray

Lead Economist, Climate & Sustainability

Ruchira Ray

Lead Economist, Climate & Sustainability

Sydney, Australia

Ruchira joined Oxford Economics Austalia in 2019, in macroeconomic consulting. Ruchira has worked on several buy side and sell side Due Diligence projects for assets spanning energy, transport, and real-estate. Additionally, Ruchira leads our climate change consulting team in Australasia.Ruchira also has experience in the energy sector, working on several gas and electricity outlook reports for the Australian Energy Market Operator (AEMO), leading the development of industrial sector demand forecasts including regularly interviewing energy intensive industrial users of gas and electricity; producing retail gas price forecasts and conducting scenario setting consultation with industry.Ruchira is also well versed with operating our Global Economic Model (GEM) to produce scenario forecasts.

Our work

Case Study | Australian Energy Market Operator

Oxford Economics Australia and AEMO’s 2022-23 Energy Outlook Collaboration

Project background The Australian Energy Market Operator (AEMO) engaged Oxford Economics Australia (OEA) to develop economic and demographic scenario forecasts for their 2022-23 energy outlook reports. AEMO, responsible for Australia-wide planning and forecasting publications, required these forecasts as inputs into their modelling processes. The scenarios, outlined in AEMO’s Inputs, Assumptions and Scenarios Report, were developed…

Find Out More

Case Study | Australian Energy Market Operator

Review and validation of AEMO’s cost of capital assumptions for renewable energy investments

Project background The Australian Energy Market Operator (AEMO) engaged Oxford Economics Australia (OEA) to review their cost of capital assumptions for long-term investments in the National Electricity Market (NEM). The review aimed to assess the impact of asset-specific and market risks on the cost of capital. The cost of capital assumptions are key to developing…

Find Out More