Research Note | 27 Jun 2024

Engineering construction data shows signs of changing gears

Construction & Infrastructure Consulting Team

With the current weakness in residential building and key commercial and industrial segments of non-residential building, growth in engineering construction has been a support for the construction industry and – given the multipliers involved – the broader economy (Engineering construction covers transport, utilities and mining and heavy industry construction).

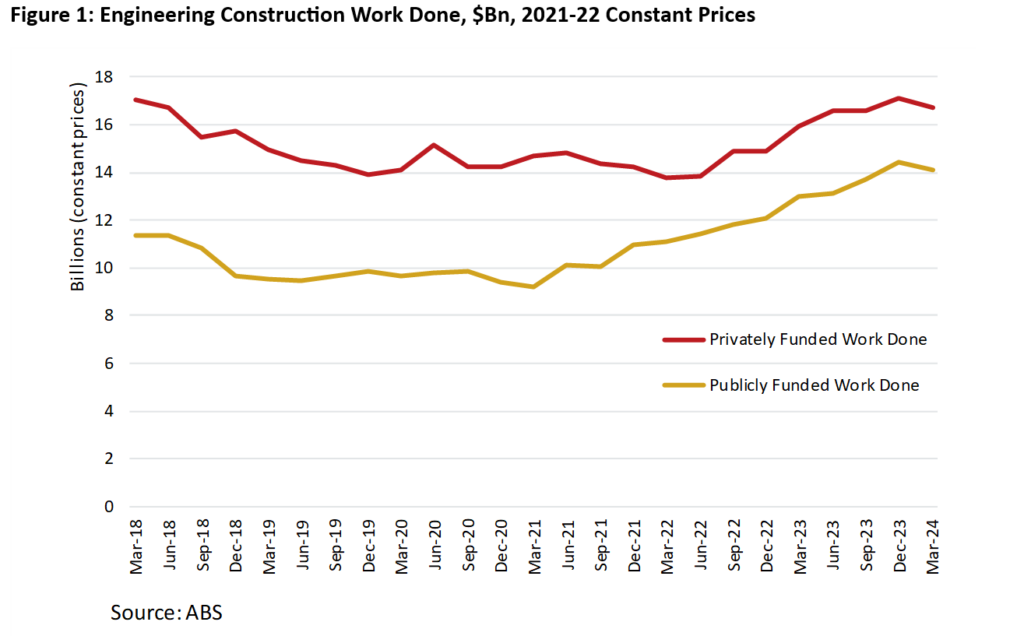

Given this, yesterday’s release of the latest, detailed, engineering construction work done data is food for thought. Overall, engineering construction activity fell 2.3% in real terms in the March quarter 2024, with the fall equally balanced across the public (-2.4%) and private (-2.2%) sectors. Engineering construction work done is still considerably higher than it was a year ago, but growth is definitely slowing from the double-digit pace of the past year.

Interestingly, the March quarter sees the first real quarterly decline in public sector funded work in over 2 years – and the largest decline since Australia was in the thick of the pandemic lockdowns in 2020. Since then, publicly funded engineering construction work – particularly in the road and rail segments – had been on a tear, with public sector funded work done rising from around $10bn a quarter back then to around $14bn a quarter as at March (in real terms).

At Oxford Economics Australia, the March quarter outcome for public sector funded work done was not unexpected. The 2.4% fall in the March quarter comes directly after 10% growth across the September and December quarters, so this could be a case of public infrastructure activity ”catching its breath”. We will be watching future quarters to see if this weaker data point becomes a trend.

However, while there will no doubt be few bumps up and down from here, it is likely Australia is nearing the end of a strong growth phase in publicly funded engineering construction work, particularly in the transport sector. This is reflected, too, in commencements data, with publicly funded commencements down 15% in the March quarter and around 20% year on year. It’s also reflected in infrastructure investment projections in recent Budget papers (with some notable exceptions). Given existing work in the pipeline, overall public sector funded construction activity is expected to be sustained at relatively high levels, but growth will likely continue to slow.

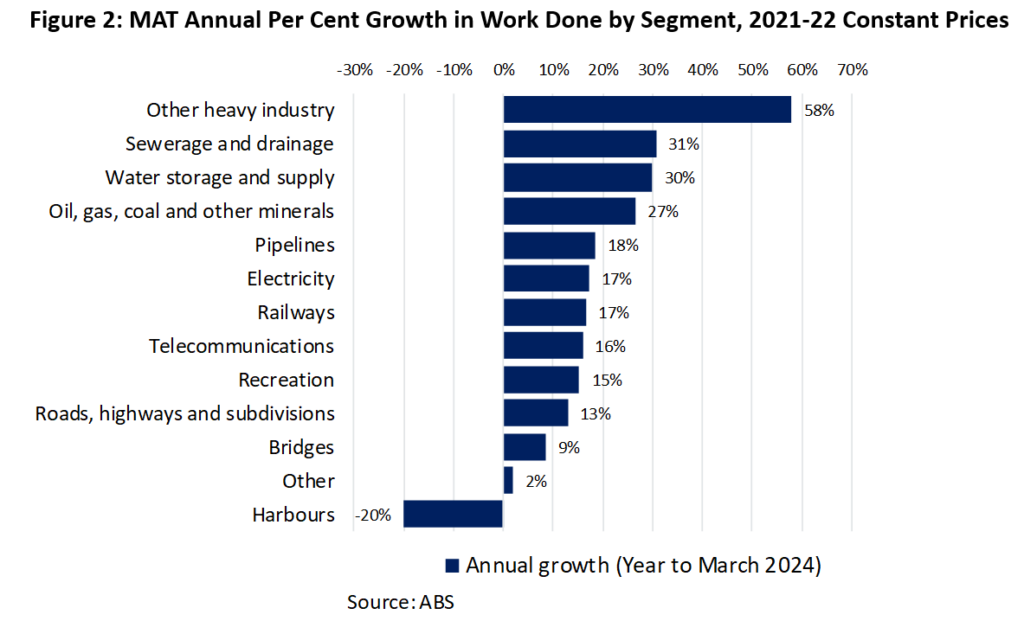

So where is growth occurring? Over the year to the March quarter, , apart from mining and heavy industry segments (which are also strengthening), several utilities-oriented engineering construction sectors stand out:

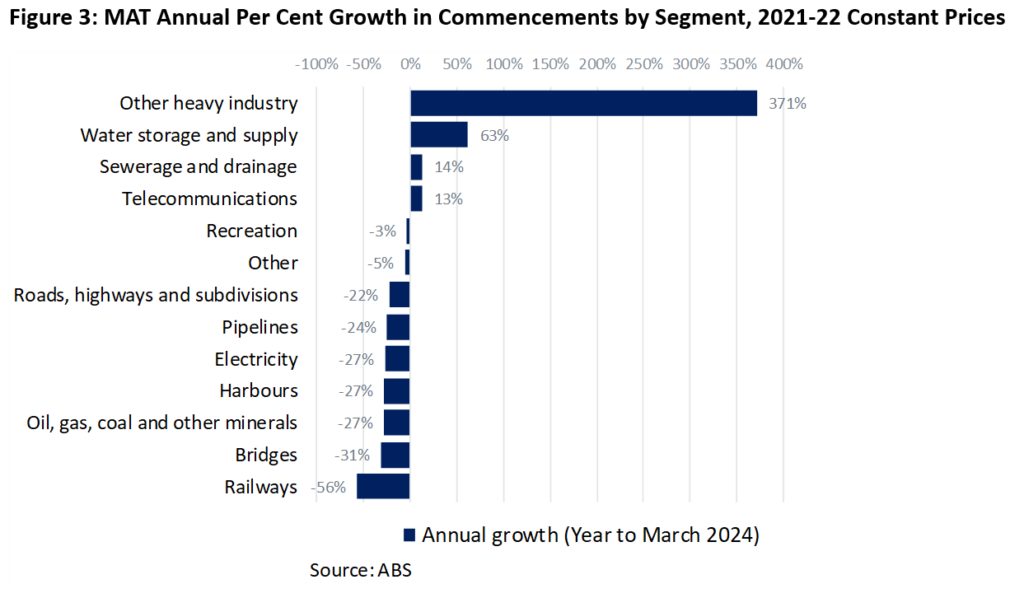

- water supply and storage (+63% growth in commencements and +30% growth in work done)

- sewerage and drainage (+14% / +30%)

- telecommunications (+13% / +16%)

This is again, not surprising. We have been discussing a transference of growth from transport to utilities at Oxford Economics Australia for some time, and water infrastructure is key to so many policy objectives. We should expect a lot more of this. Telecommunications investment is strong now, but faces risks ahead as nbn investment winds down.

What is concerning is the activity in the electricity sector, which should be seeing very strong growth right now to get Australia on track for transition of the grid to low emissions technologies. While the annual value of work done has risen 17% over the past year, commencements have fallen by 27% over the same period. The March quarter value of commencements – $3.1bn – was the lowest value in over 3 years. The overall electricity construction pipeline (at over $20bn and possibly inflated by growing costs at Snowy 2.0) is still large but a substantial ramp up in new project starts is required for Australia to meet its energy transition targets. This week, the Australian Energy Market Operator (AEMO) reiterated its call that the pace of renewables investment has to quicken to meet its optimal development pathway. The March quarter engineering construction data backs that view.

Your Author

Adrian Hart

Director, Construction and Infrastructure, Oxford Economics

+61 (0) 2 8458 4233

Adrian Hart

Director, Construction and Infrastructure, Oxford Economics

Sydney, Australia

Adrian has over 25 years of economic analysis and consulting experience with Oxford Economics Australia, focusing on the infrastructure, building, maintenance and mining industries. Adrian has undertaken a wide range of consultancy projects for the public and private sector based on his detailed understanding of construction, mining and maintenance markets, their drivers and outlooks, the range of organisations operating in this space and the issues they face. This work includes deeper industry liaison, contractor and competitive analysis, pipeline analysis, demand and cost escalation forecasting, and industry capacity and capability projects for the public and private sector. He is the lead author of major reports but also undertakes briefings and workshops for senior management, board members and industry associations, leads in-depth stakeholder consultation, and facilitates and chairs roundtables between government and industry.

More Research

Post

Cost escalation pressures are easing but key risks remain

Construction cost escalation has slowed from the unprecedented inflationary spike experienced by the sector in 2022 and 2023. The recent surge in construction costs was primarily driven by supply-side factors; commodity market volatility and the energy cost crisis has shifted up manufacturing and transport costs, compounded by supply-chain disruptions from the lingering impacts of the pandemic.

Find Out More

Post

Australian Non-residential building major project outlook for 2024

A pipeline of major projects (contract value at or above $50 million) totalling $15.4 billion nationally is expected to break ground in calendar year 2024

Find Out More

Post

Australia’s non-residential building approvals set a weak lead

The approvals lead for non-residential building continues to soften, with March quarter 2024 maintaining the recent downward trend in project approvals. While a normalisation beyond COVID continues to impact for some sectors, broader cyclical demand drags are becoming more obvious.

Find Out More

Post

Australian Federal Budget highlights several themes for building

The 2024/25 Federal Budget delivered little to shift the outlook for building construction, although there was modest movement connected to housing, tertiary education, manufacturing, and defence.

Find Out More

Post

Australian federal budget delivers no surprises

The 2024-25 federal budget affirmed the forecast changes we made in the April 2024 edition of our Engineering Construction in Australia (ECA) service. We continue to expect publicly funded activity to average $54.1bn over the five years to FY28, compared to an average of $42.1bn over the five years to FY23.

Find Out More