Research Briefing

| Jul 25, 2024

Australia’s commercial property value reset: how much further to go?

Higher interest rates have pushed up the risk premium required from prime commercial property. Yields have softened as interest rates and bond yields moved higher, resulting in falling capital values.

Access the research report to learn more about the key points outlined below:

- Recent benchmark transactions, our expectation that bond yields will gradually fall from here and signs of improvement in occupier markets indicates to us that we are at or near the market trough of the price correction. However, some further asset value declines are possible during FY2025 given the lag of valuations to market.

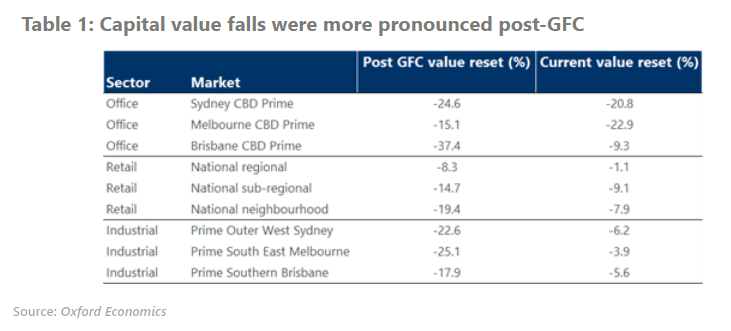

- Commercial property markets should stablise through the second half of 2024 as investors become more comfortable determining property values and return expectations. We believe the current reset in capital values will be less pronounced than the post-Global Financial Crisis (GFC) reset and have a similar or faster recovery, depending on asset class.

Tags: