Blog | 30 Sep 2024

From transport to energy – the impact of engineering construction cycles on the regional outlook

Daniel Rahme

Economist, Construction & Infrastructure

Engineering construction cycles and their regional impact

The Australian engineering construction industry is characterised by booms and busts of activity, not only by subsector and state but by regions within states and territories. From the regional and remote mining investment boom of the 2000s and 2010s to the large programme of publicly funded transport megaprojects in Australia’s capital cities, overall activity in the civil construction sector is continuously being shaped by cycles. The next engineering construction cycle – driven predominantly by the electricity subsector, but also water, resources and Defence projects – is already underway.

Unlike building construction, data collected from the Australian Bureau of Statistics’ quarterly Engineering Construction Survey, while extremely detailed at a state level, does not capture intra-state movements in activity (e.g. activity at the Statistical Area Level 4, or SA4 level). However, deeper project and programme level analysis undertaken by Oxford Economics Australia combined with our longer-term forecasting reveals which regions will see the biggest growth in engineering construction activity over the coming decade.

This is important as large cycles in engineering construction activity represent a challenge to industry capability and resource allocation (plant, labour, equipment and machinery) – particularly as they drive shifts in the regional distribution of activity (and hence the location of resource demands):

- A near decade long resources investment cycle drove large increases in regional activity over the 2000s and 2010s. Apart from mining projects themselves, associated works across pipelines, railways and harbours supporting LNG production across Queensland and Western Australia saw some regions such as Central Queensland and Outback-North experience a huge cycle in works that was challenging to supply.

- The construction of road and rail ‘mega projects’ saw construction work swing back to major metropolitan areas from the mid to late 2010s – and has up to now been a key driver of construction growth across ‘post resources boom’ Australia. With a significant share of the existing transport pipeline yet to be completed, the level of construction activity in Australia’s cities is expected to remain broadly unchanged over the near term.

- The transition in construction towards renewable energy, water security and resources projects is anticipated to deliver yet another change in where work will be done. Once again, similar to the resources boom, an increasing share of construction activity is expected to be undertaken outside of capital city metropolitan regions.

Engineering construction ‘heat’ to rise again in regional areas presenting opportunities and risks

Unique long-term analysis undertaken by Oxford Economics Australia’s Construction and Infrastructure team indicates that Australia’s regions will be ‘winners’ in terms of growth in engineering construction work over the next decade. While this will represent an economic boom for the regions, it will also create challenges in how to resource regional projects efficiently, how to attract scarce skills and how to accommodate and provide other services to temporary construction workforces in regional communities.

Overall, engineering construction activity is forecast to increase across 51 of the 57 SA4 regions over the next decade. We are forecasting 16 of 57 SA4 regions across Australia to see at least a 50% lift in real construction work from FY24 to FY30, with 3 SA4 regions expected to see real construction activity more than double. Electricity-related construction is expected to underpin much of the growth along with a resurgence in mining and heavy industry construction.

Electricity construction is anticipated to increase by nearly 30% in real terms, exceeding $26 billion in annual work done by FY30. Despite an expected fall in transport activity, the volume of engineering construction work over the coming decade (2024-2033) compared to the previous decade (2014-2023) for most regions across the country is expected to be greater.

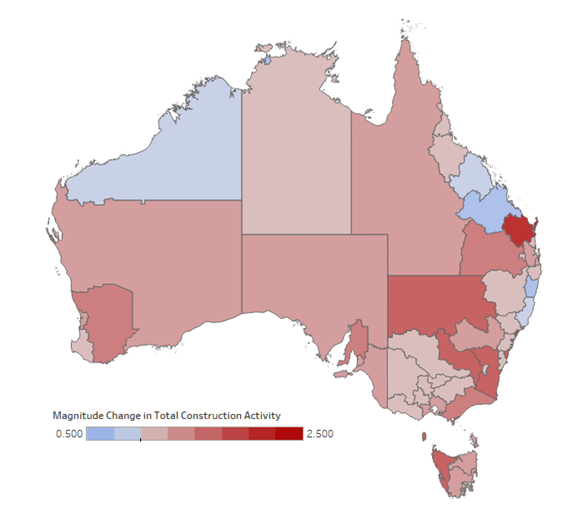

The heatmap below shows which regions are likely to see higher levels of activity over the next 10 years, compared to the previous 10 years. A ratio above 1 indicates a higher level of activity over the next decade.

Fig. 1. Magnitude Increase in Total Construction Activity by SA4,2024-2033 against 2014-2023

Which regions will benefit most from the renewable energy transition?

A key feature of the increased investment in renewable energy generation is its regional focus. Most renewable energy developments will continue to occur outside greater metropolitan areas. Mega-projects, such as multi-billion dollar pumped hydro developments, are forecast to bring record levels of activity to certain regions.

- The Capital Region (NSW) region is expected to benefit from the forthcoming cycle – home to the Snowy Hydro, the ongoing Snowy 2.0 Pumped Storage is set to underpin a more than doubling in the volume of activity compared to the previous decade. Solar and wind developments in the Dinawan Energy Hub will further the region’s electricity activity. The Riverina region is expected to also benefit from the Snow Hydro development, with tunnelling and pipeline work connecting the Talbingo Dam similarly supporting a near doubling of construction activity.

- The Hunter Valley and Illawarra are expected to benefit from New South Wales’s transition to renewable energy generation. The Kurri Kurri Gas Plant, Liddell Big Battery and Illawarra Offshore Wind Zone construction will support development in these regions. These two regions also have an upside risk to their outlook. Hydrogen hubs in these regions may see increased activity with further facilities potentially added to the pipeline of projects if the economic feasibility of hydrogen improves. This is likely to occur if the export market improves. Changes in international energy requirements could increase demand for Australian hydrogen. The requirement implemented for Data Centres in Singapore to increase their usage of green energy is an example of such a change.

- Around the rest of the country, the renewable energy boom is expected to drive activity in Wide Bay (QLD) and West and North West (TAS). The Borumba Pumped Hydro project is expected to drive total construction to over double for Wide Bay in the coming decade. The Pioneer-Burdekin Pumped Hydro facility scheduled for the Mackay – Isaac – Whitsunday region is anticipated to further Queensland’s regional construction activity – in combination, these two pumped hydro facilities will bring an estimated $15.7 billion of engineering construction to regional Queensland. The West and North West region in Tasmania is also forecast to undergo a doubling of construction activity. The development of Lake Cethana Hydro and Marinus Link activity will drive activity in the southern region.

New investment in generation is anticipated to be supported by widespread transmission and distribution work to connect these projects to the grid. Additionally, existing networks will need to be upgraded – in order to fully utilise the scheduled renewable developments, the capacity of the existing infrastructure will need to be improved.

Water infrastructure also a key driver of regional investment and construction

The reprioritisation of water security developments will further add to the regionalisation of engineering construction activity. Major desalination projects will support growth across the South East of Queensland and widespread capital expenditure in New South Wales will strengthen investment. Specifically, the Gold Coast Desalination Plant upgrade (Gold Coast, QLD) and a second South East Desalination development (TBC) are expected to inject over $5 billion worth of construction over the outlook. Additionally, a third desalination plant in Perth (Greater Perth, WA) and the Dampier Seawater Desalination Plant (Outback-North, WA) will support growth in Western Australia. Far Wests & Orana (NSW) is also expected to endure an uptick in water activity from the Western Weirs program.

Some regions expected to see falling activity over the coming decade

Whilst overall engineering construction activity is forecast to increase in the coming years, a few regions are expected to see a decline in total activity. Western Australia’s Outback-South region will see overall activity fall over the next decade compared to the previous decade as the record level of pipeline development from the mining boom boosted the region to historically high levels. Whilst construction in the region is forecast to be more muted, the region is a set for relatively consistent decade of work above pre-mining boom levels. The development of the Coffs Harbour Bypass, along with other road and bridge construction, has supported construction activity in recent years for the region – but activity is forecast to cool from these record levels as the Bypass moves to completion. Tasmania’s South East region is also anticipated to endure a fall over the coming decade due to slowing water, road and electricity developments.

Strong growth presents opportunities but also challenges

Growth in regional investment is a positive for regional and remote economies and communities. Nonetheless, many regions can be expected to face significant challenges and risks from rising activity. Regional contractors generally prefer either steady levels or manageable growth in activity – not large cycles that require sudden upsizing and downsizing of staff numbers. Larger state government or privately funded projects can drain the skills pool available to local councils for ongoing works and maintenance (or simply attract skills directly from regional councils). Consequently, attracting and accommodating additional labour to regional areas will be vital to delivering the next cycle of work. Increased regional knowledge and coordination of the pipeline, removing or lowering barriers for labour mobility and allowing more time for planning and development will support the outlook.

At Oxford Economics Australia, we have developed significant expertise in understanding engineering construction activity at a regional level. We produce capacity studies of skills, materials, plant and equipment, for regional areas, combining our (and our clients) understanding of future work in a given region, along with insights from industry stakeholders. Our understanding of global, national and regional construction, commodity and labour markets allows us to understand and forecast cost escalation in regional areas. Should you require any assistance in understanding regional demand, supply and cost pressures, please do not hesitate to contact us.

Your Author

Daniel Rahme

Economist, Construction & Infrastructure

Daniel Rahme

Economist, Construction & Infrastructure

Sydney, Australia

More Research

Post

It’s a bumpy road but Australia’s 2030 climate target is within sight

Following hawkish comments from the Reserve Bank of Australia and a rise in monthly CPI indicator readings in the last two months, markets are pricing in a higher probability that the RBA will hike interest rates at its next meeting in August. We think this speculation is overblown.

Find Out More

Post

Engineering construction data shows signs of changing gears

With the current weakness in residential building and key commercial and industrial segments of non-residential building, growth in engineering construction has been a support for the construction industry and – given the multipliers involved – the broader economy. (Engineering construction covers transport, utilities and mining and heavy industry construction.)

Find Out More

Post

Roads Australia | Cost escalation pressures are easing but key risks remain for the roads industry

Leading infrastructure industry organisation Roads Australia's 'Industry Perspectives' column has highlighted analysis from Associate Director Adrian Hart & Senior Economist Thomas Westrup.

Find Out More