Research Briefing

| Oct 2, 2024

Private sector weakness in Q2 prompts a growth downgrade

Key Points

- Australia’s GDP growth was broadly in line with our expectations in Q2 at a meagre 0.2% q/q. The economy is lacking a clear engine of growth, and the private sector is clearly struggling against restrictive policy settings. Public demand growth continues to prop up GDP growth but at the cost of exacerbating inflation pressures, which remain broad and elevated. We still expect the economy will gain momentum over H2, but we’ve lowered our 2024 growth forecast to 1.1% from 1.3% previously. We now expect growth of 2.1% next year, down from 2.6%.

- Employment growth has been remarkably strong recently, with another 58,200 jobs added in July. Nevertheless, increasing supply is matching demand, and the labour market is gradually slackening. Australia’s unemployment rate is now up to 4.2%. Consistent with the easing in conditions, private sector wage growth slowed down a little further in Q2.

- Productivity growth returned another troubling print in Q2, falling by a further 0.6% q/q. The ongoing productivity malaise is clouding the inflation outlook and keeping the Reserve Bank of Australia attuned to upside risks. Although we still expect an improvement in productivity growth in the coming years, we’ve lowered our forecast for near-term productivity growth.

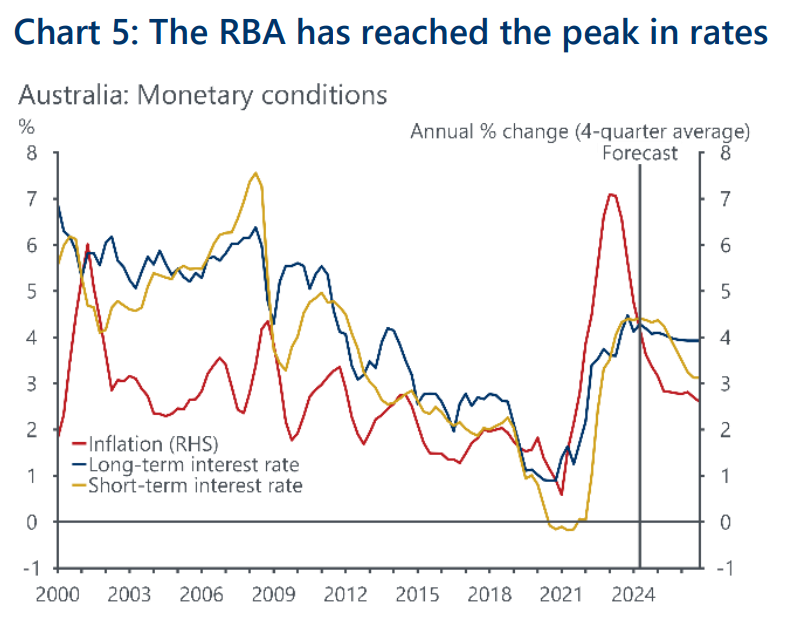

- We’ve kept our near-term outlook for interest rates unchanged, and expect the RBA will start its rate cutting cycle in Q2 2025. But we’ve raised our estimate of the neutral rate for Australia by 50bps to 3.1%, following a similar revision to our US outlook. Alongside tighter policy settings, we’ve revised our estimate of the natural rate of unemployment to 4.4%.

Download the full research report to learn more.

Tags: