Research Briefing

| Oct 14, 2024

Melbourne CBD office market 2024 – 2034

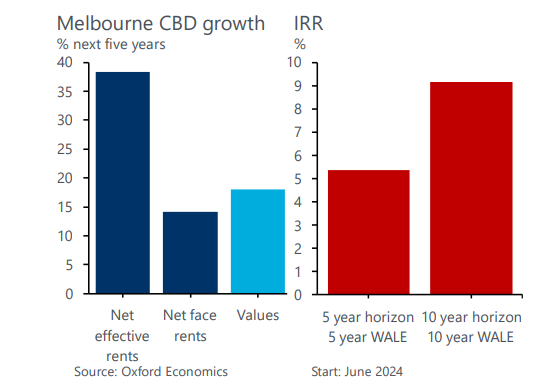

- Vacancy in the Melbourne CBD continued to track higher during H1 2024, increasing to 18.0%, reflecting the persistent contraction in office demand. We expect the vacancy rate is at or near its peak however, we won’t see substantial falls in vacancy until 2027 when supply additions dry up. The forecast trough in vacancy is now expected to occur in 2032 at around 6% to 7%. Beyond some slight near-term falls, we expect a long upswing in effective rents (+90%) post FY25 to the next peak in 2033. Average prime yields softened by 95 bps in FY24, and we forecast yield expansion will continue through H2 2024. This will see a ~20% fall in capital values from their 2022 peak, resulting in weak 5-year IRRs from a June 2024 start (5.4%) but stronger over 10-years (9.2%).

- The return to the office in Melbourne has been slower than anticipated and continues to lag other CBD markets, impacting demand and occupancy levels. Net absorption was negative in the Melbourne CBD during FY24 reflecting slower economic and SAOWF growth. We anticipate net absorption will return to positive territory for CY24 (with risks to the downside) and revert to long-term average levels from 2025, boosted by the strength of the economy and employment growth. The supply pipeline in the Melbourne CBD remains active however, there are signs of moderation emerging, but completions (213,000 sq m) out to 2026 will impact the speed and timing of the recovery.

- Average incentive levels (at 46% for prime) rose in FY24 with upward pressure expected to remain through FY25, with vacancies at or near their peak. We expect small declines in effective rents near-term and only modest growth over the next few years as incentives start to unwind. Rents are forecast to improve at a stronger pace from 2027 to a peak in 2033, with trough to peak gains of about 30% (stated) and 90% (effective). We expect a further 10-15 bps softening in yields for H2 2024, with minor declines in capital values.

- Upward revisions to the vacancy rate profile to reflect weaker than expected net absorption in H1 2024.Minor supply pipeline adjustments due project delays and postponed commencements.

Tags: