Research Briefing

| Nov 4, 2024

Smaller supply phase in Australia aiding office market recovery

Access the research report to learn more about the key points outlined below:

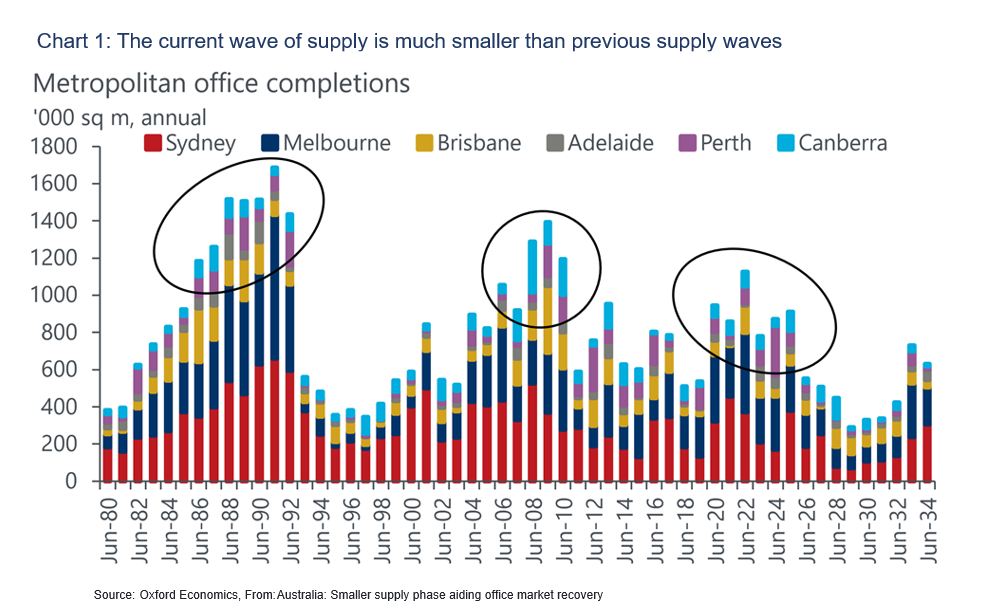

- Australia’s major metropolitan office markets are at the tail end of a major phase of supply that started in FY20 and will run to mid next year, in the process contributing towards the current substantial oversupply. However, the current supply cycle is smaller than the previous two and, with completions forecast to fall away from FY26 and not pick up again until 2033, will help the markets recover when the next demand upswing comes through.

- There have been three major supply waves over the past four decades, decreasing in scale over time. Before the end of each cycle there was a downturn in demand, which resulted in oversupply, before completions slowed and vacancy rates started to recover. We think we are at or close to the vacancy rate peak in the current cycle, with markets about to enter a long, slow recovery phase

- The pandemic triggered downturn in office demand was much bigger than after the GFC and the early 1990’s bust, but the smaller proportionate supply phase this time around means the markets are entering the recovery period with vacancy rates topping out between the previous busts. i.e. current vacancy rates would have been much higher if previous supply cycles had been repeated.