Research Briefing

| Feb 3, 2025

Three questions that will shape the RBA’s February rate call

Access the research report to learn more about the key points outlined below:

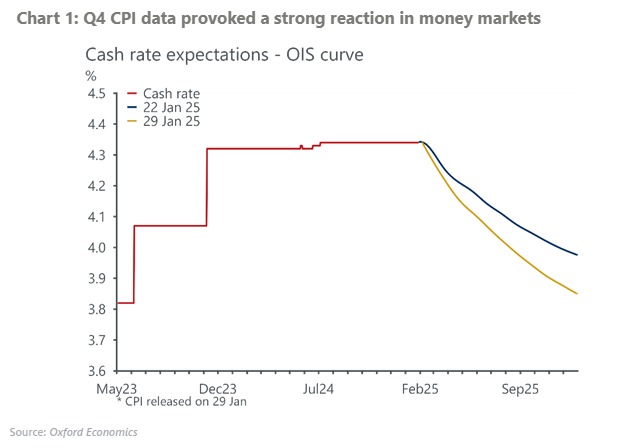

- The Q4 CPI data provoked a sharp reaction in markets, with the probability of a cash rate cut in February now priced in at 95%. We think the decision is a coinflip and will be decided by the RBA’s view on the following three key questions.

- How quickly and sustainably is inflation coming down? The last two CPI prints have been affected by subsidies. These have weighed heavily on headline inflation, but the breadth of the subsidies has also impacted the RBA’s preferred measure of core inflation. The bank will need to assess where inflation currently sits once subsidies are accounted for and whether inflation will be at target when the subsidies lapse and inflation spikes later this year.

- How much spare capacity is in the economy? The labour market has been a persistent source of surprise over the past couple of years. The unemployment rate is remarkably low at 4%, and job vacancies took a surprising step up in November. Overall, the labour market is beyond the RBA’s estimates of full capacity, which is inflationary. The RBA may reassess the level of the unemployment rate they see as sustainable for inflation to be at their target. But absent a change in their view, this provides a strong argument for keeping rates on hold in February.

Tags: