News | 07 Dec 2023

Another soft GDP figure confirms Australia’s momentum is fading

Sean Langcake

Head of Macroeconomic Forecasting, Oxford Economics

-

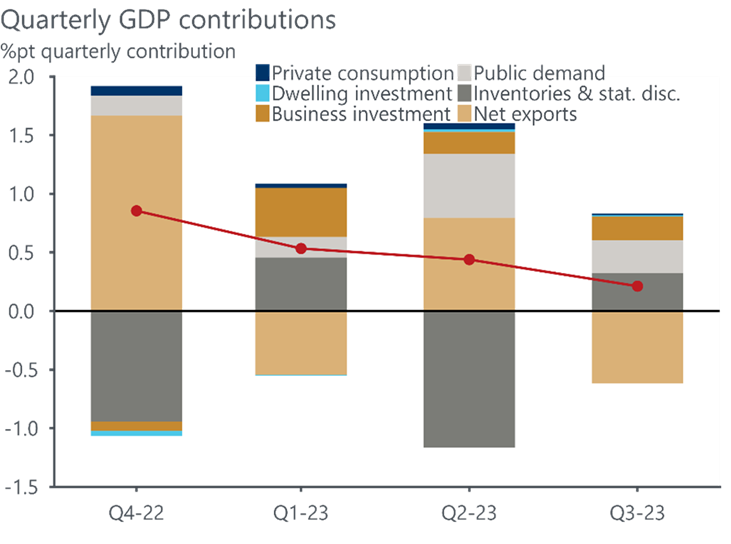

GDP growth moderated to 0.2% q/q in Q2, taking the y/y pace of growth to 2.1%. Household spending was flat in the quarter despite strong population growth, while net exports subtracted 0.6 ppts from growth in Q3. To the upside, construction on mining infrastructure projects, public demand and an accumulation of inventories boosted growth.

-

Today’s data came in a little below our already modest expectations for growth of 0.3% q/q. Momentum in the economy is clearly waning, with output per capita falling by a further 0.5% in the quarter. We expect conditions will remain patchy over 2024 as the economy grapples with restrictive policy settings as the RBA looks to rein in inflation.

Household spending was broadly flat in Q3, reflecting budget pressures faced by households at present. Government subsidies for child-care and utilities contributed to some of the weakness, with this spending reflected in higher government consumption rather than private consumption. Discretionary spending was boosted by another strong quarter for vehicle sales and activity around the FIFA Women’s World Cup. Household income growth was modest in the month. Labour income continues to grow at a brisk pace, with compensation of employees up 2.5% q/q, aided by the tight labour market and recent increase in award wages. But income tax payable increased strongly in the quarter due to the removal of the Low and Middle Income Tax Offset. The weakness in income growth and strength in consumer prices contributed to another fall in the savings rate, which is now just 1.1%.

Investment activity made a steady contribution to growth in the quarter, led by mining infrastructure projects. Dwelling construction ticked up a little, which is a relatively weak result given the large pipeline of work to be done. Public investment and machinery & equipment spending was pared back after a surge in activity in Q2. Inventory accumulation contributed 0.4 ppts to growth, led by a build-up of mining inventories that came despite lower production and exports. Productivity growth improved in Q3, with GDP per hour worked up 0.9% q/q. Today’s data show that price pressures remain elevated in the economy, with domestic prices increasing by 1.3% q/q. But the stronger productivity result will help limit the pass through of these pressures to final prices.

Contact us

If you would like to find out more about any of our services, please fill in the form and let us know a bit more about you and what you’re looking for. A member of the team will be in touch with you as soon as possible.

By submitting this form you agree to be contacted by Oxford Economics about its products and services. We will never share your details with third parties, and you can unsubscribe at any time.

Technical issues with My Oxford?

If you are having a problem with the My Oxford platform, including issues logging in, please contact the support team.

Alternatively, you can visit Oxford Economics’ help and support page.

Explore our services

Service

Australia Macro Service

The Australian Economic Forecasts provides in-depth insights and analysis of key domestic and global trends.

Find Out More

Service Category

Consulting Services

Our consulting team develops bespoke solutions to help clients tackle their most important issues. The team applies economic frameworks and our proprietary models to complete more than a hundred projects every year for local and global organisations.

Find Out More

Service Category

Subscription Services

A comprehensive portfolio of Australian economic reports, databases and analytical tools on a subscription basis

Find Out More