Blog | 27 Mar 2025

Australia’s Construction Outlook: Market capacity challenges to continue

Adrian Hart

Director, Construction and Infrastructure, Oxford Economics

Australia’s Construction Outlook: Market capacity challenges to continue

Although growth has slowed, rising construction work this decade requires a laser-like focus on improving productivity and skills accumulation

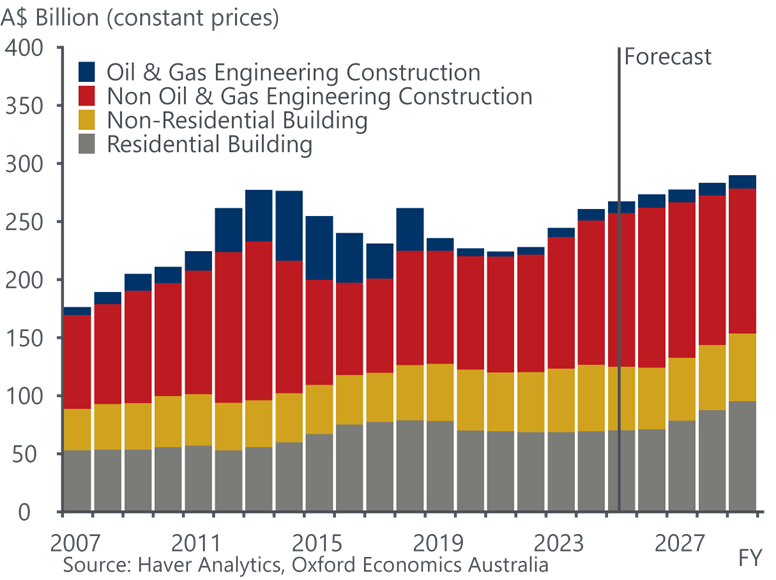

As highlighted in our February 2025 construction conferences, growth in total Australian construction activity slowed in 2024 but remained positive. While the national outlook for construction activity remains positive overall (see Figure 1 below), unsynchronised cycles unfolding across residential building and engineering construction will act to constrain real growth in construction work over the remainder of this decade.

Figure 1: Total Construction Work Done, Australia, A$Billion (constant prices)

Source: Oxford Economics Australia, ABS data

Yet even this modest outlook for construction presents challenges for the industry and asset developers (including governments). Our forecasts indicate that growth in construction work will not be even across Australia with a significant cooling of activity in Victoria and softer growth in New South Wales more than offset by stronger growth in Queensland and Western Australia. More activity is set to take place in regional areas as the transport investment boom gives way to twin booms in water and electricity work. The sheer scale of investment in energy transition will create its own distinct challenges. And the type of work we will deliver will add complexity to the task, with the strongest growth in relatively new build forms (e.g. data centres, advanced warehousing and logistics, pumped hydro) or forms we either haven’t built in a while or are relatively difficult (dams, harbours, hospitals, defence works and desalination plants).

The upcoming residential upswing will eventually lift construction activity in all states, but do not expect it to arrive quickly. While approval numbers are improving, actual work done on building dwellings is still in decline nationally. It will take time to get new projects moving here, particularly the larger high-density developments that will do the necessary heavy lifting in increasing dwelling supply. With only one interest rate cut so far – and caution on the pace of further cuts in this unusual cycle – there is still a large gap between what is affordable to buy and what is feasible to develop. Consequently, we do not expect a strong pickup in residential building activity until FY27 but, as in previous cycles, when it does come through it will drive growth in the construction market and the broader economy until the end of the decade.

Until then, construction activity will be sustained mostly by peaking transport work, as well as a large cycle in utilities on the civil side and data centres and hospitals on the building side. Transport infrastructure alone is projected to peak at almost $50 billion by FY26 but will fall away significantly from FY27. By contrast, the expansion in renewable energy projects essential to Australia’s transition to net-zero will see electricity construction grow by over 33% from current levels, reaching above $25 billion annually by 2030. Work on building data centres – with their own requirements for energy and water cooling is rising exponentially – and we are at the front end of a large cycle in harbours (supported by defence spending) and health building. Meanwhile, water-related construction has risen 55% in real terms over the past three years, and we are forecasting water-related construction activity to be a third higher again on average through the next five years. It’s been an area of significant underinvestment over the past decade.

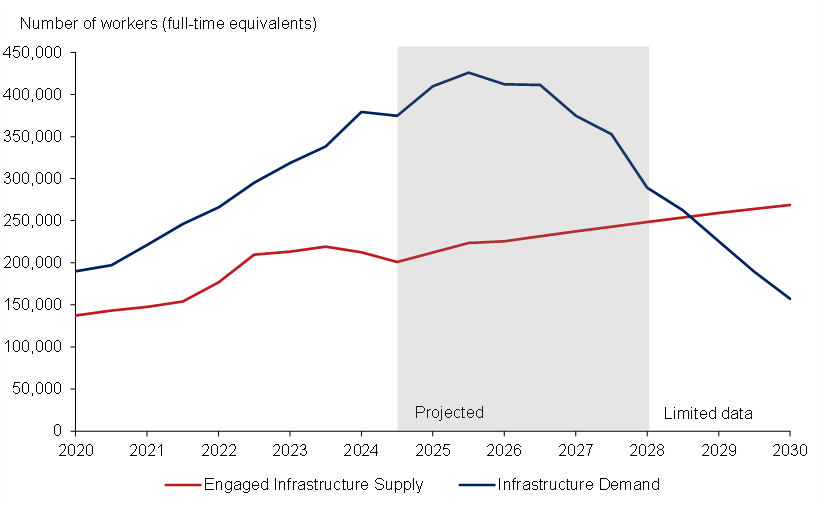

Delivering this ambitious pipeline of work without incurring further significant cost overruns will be a real achievement. Unlike Infrastructure Australia’s recent assessment of market capacity risks – which ultimately depends on a sharp decline in construction activity (i.e. investment, which in turn would have severe, if unmodelled, economic consequences) to bring market capacity back into balance – our analysis indicates that capacity risks will remain high this decade, and intensify without further policy actions to boost skills and productivity.

Figure 2: Demand and Supply of Infrastructure Workers

Source: Infrastructure Australia, 2024 Market Capacity Report, p51

Infrastructure Australia’s assessment of market capacity is based on a detailed bottom up, project-based view of construction labour demand. But this perspective is limited by project visibility (which, to their credit, Infrastructure Australia acknowledge). There will be new, as yet unknown projects, that will emerge later this decade. We can expect to see further large private investment in mining, heavy industry, energy generation, harbours and eventually commercial and industrial building. Critically, a large upswing in residential building work will be underway across every state and territory by FY27 (some states are further ahead on this than others) and if current poor productivity trends in dwelling construction continue this will absorb more of the construction workforce than it should.

In turn, sustained demand for labour (and recent multi-year industry wage bargains designed to recapture losses from the sharp decline in real wages during the last two years) will lock in real construction wage growth for the next three years. While growth in materials costs (particularly steel) has slowed substantially over the past year, it is now stronger wage growth which is driving further real growth in construction costs. Looking ahead, sustained real wage growth – if not offset by productivity improvements – will see real unit labour costs rise, pushing real construction costs higher through this decade, not lower. Our long run analysis shows that since 2000, construction cost growth has outpaced general inflation by 0.8% per annum, and there is little reason yet to think the next five years will be very different. In other words, don’t expect infrastructure spending to become cheaper anytime soon.

Improved productivity remains the ‘X’ factor which could help boost market capacity and keep a lid on cost escalation. Timely analysis from the Reserve Bank of Australia helps to shed some light on why Australia’s productivity performance has been very poor in recent years, how big a problem it is and what the solutions may be. At the Australian Business Economists Annual Forecasting Conference in Sydney last month (sponsored by Oxford Economics), the Reserve Bank’s Dr Michael Plumb highlighted the failure of business investment to keep pace with population growth. In part this may be due to stronger employment growth in traditionally ‘low productivity’ service sectors (where productivity is also notoriously difficult to measure) but might also reflect that, in per capita terms, our workforce growth has outpaced growth in access to productivity enhancing equipment and tools. This worsening in ‘capital deepening’ follows strong growth in the capital/labour ratio during the first half of last decade (timed with the resources boom which coincided with a boost to measured productivity) and a fairly flat and stable capital/labour ratio up to the pandemic (which coincided with a weaker productivity performance).

While this can be fairly described as a wake up call to industry to do better (as per Ross Gittens’ recent article in the Sydney Morning Herald) I would argue there is still a significant role for government in achieving better productivity outcomes in the construction sector for four main reasons:

- Its role in driving human capital accumulation (i.e. boosting skills from education and training in the VET sector as well as our public school system – in particular, VET completions in building and construction related trades are down 50% from a decade ago – more on this in future blogs)

- How it can determine industry regulation

- How it can demand better productivity outcomes from industry in the way it procures large infrastructure projects and programs of work, and

- Finally, how it can more efficiently share risks with industry to unlock greater innovation in design and delivery rather than sticking to stock-standard prescriptive approaches.

However, I despair that we won’t hear anything much about productivity in the upcoming Federal election campaign. As The Age and Sydney Morning Herald’s Economics scribe, Shane Wright, mentioned at the same ABE forecasting conference:

“For some of us, it appears we’ve been talking about productivity for the best part of 20 years, with very little being delivered via the political system. But perhaps we’re looking in the wrong places for productivity… The election campaign that we’re about to endure will be a continuation of the issues that have plagued the world’s political and economic systems since the GFC. Throw in the fragmentation of the political system, the rise of social media to amplify any lie or mis-truth, the way the membership of political parties has given way to Instagram or X follows and likes – the political dice are loaded against an election campaign filled with productivity-enhancing policy ideas.”

Here’s hoping that 2025 turns out to be different!

Your Author

Adrian Hart

Director, Construction and Infrastructure, Oxford Economics

+61 (0) 2 8458 4233

Adrian Hart

Director, Construction and Infrastructure, Oxford Economics

Sydney, Australia

Adrian has over 25 years of economic analysis and consulting experience with Oxford Economics Australia, focusing on the infrastructure, building, maintenance and mining industries. Adrian has undertaken a wide range of consultancy projects for the public and private sector based on his detailed understanding of construction, mining and maintenance markets, their drivers and outlooks, the range of organisations operating in this space and the issues they face. This work includes deeper industry liaison, contractor and competitive analysis, pipeline analysis, demand and cost escalation forecasting, and industry capacity and capability projects for the public and private sector. He is the lead author of major reports but also undertakes briefings and workshops for senior management, board members and industry associations, leads in-depth stakeholder consultation, and facilitates and chairs roundtables between government and industry.

More Research

Post

Construction in transition:What are tomorrow’s growth driver’s?

It was fantastic to welcome our esteemed clients and guests to our construction conference in Sydney, Melbourne and online.

Find Out More

Post

Engineering Construction in Australia – Q1 2025 Update

Headline engineering construction work done rose 6.6% year-on-year to $34.4bn over the September 2024 quarter, driven by strong growth in electricity and water activity.

Find Out More

Post

Building Tomorrow’s Roads: Navigating Skills Shortages and Embracing Innovation in Infrastructure

The road infrastructure sector is facing a serious skills shortage, exacerbated by the impacts of COVID-19, increasing demands on transport projects, and rapid technological advancements.

Find Out More

Post

Queensland Government lock in Olympic venue plans in Australia

Following last October's election, a second review into 2032 Brisbane Olympics venues was undertaken. The Crisafulli government has now revealed a third and hopefully final venues plan, under which total direct investment should eclipse $10 billion, including related developments (e.g. athletes villages).

Find Out More