Research Briefing

| Jul 31, 2024

Australia’s robust fundamentals for retirement living

Market conditions for the retirement living sector in Australia are robust, with occupancy rates having surged to 95% in 2023 – near the effective rate of full occupancy. This reflects a mix of strong demand drivers and lagging supply.

Access the research report to learn more about the key points outlined below:

- Between 2006 and 2021, Australia’s population aged 65+ expanded by 1.6 million to 4.3 million. Over the same period, the number of people in this age group living in retirement villages nearly doubled to 228,452, leading to a one-percentage-point increase in the penetration rate (the proportion of 65+ residing in retirement villages relative to the total 65+ population) to 5.3%.

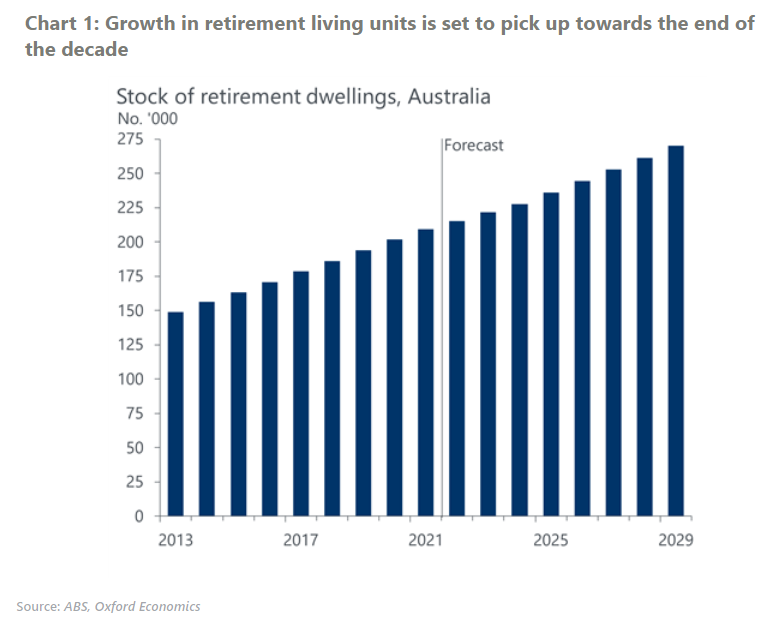

- According to the 2021 census, the stock of retirement living units has grown at an average annual rate of 4.5% over the past decade, reaching 209,452 with an average resident density of 1.2 people per occupied unit.

- There is a growing shift in retirement village build form, with developers opting to build upwards due to limited land availability in the major cities. With a wave of affluent baby boomers retiring, developments for premium retirement villages are gaining traction.

Tags: