Blog | 28 Jan 2025

The Long Road to Growth: Construction Productivity in Focus

Ronal Kumar

Lead Economist

The Long Road to Growth: Construction Productivity in Focus

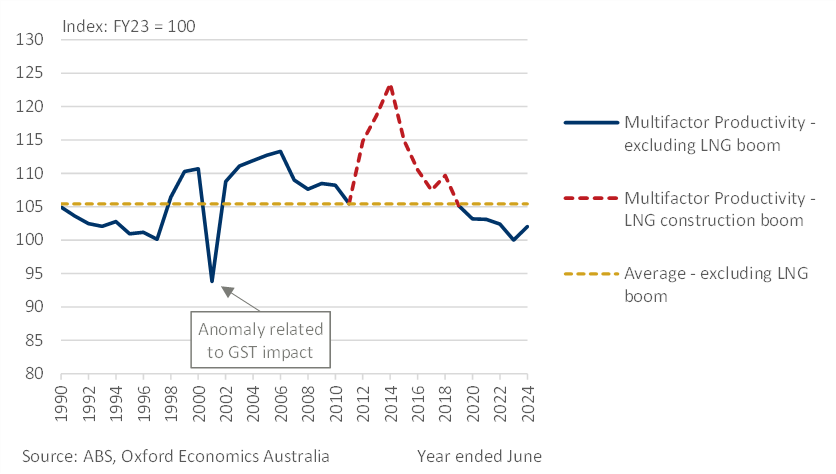

The construction industry is a critical sector of Australia’s economy, literally shaping the homes, workplaces, and infrastructure that define our cities and communities. The latest ABS data on multifactor productivity (MFP) for FY24 brings some encouraging news: a 2% increase in productivity for the construction sector. While this improvement is a step in the right direction, the broader story reveals a more complex and challenging trajectory.

Construction productivity peaked in FY14, buoyed by a period of rapid growth and large-scale projects. However, the nine years that followed saw consistent declines. A deeper dive into the data reveals that the statistics from FY12 to FY18 may have been skewed by the construction of major liquefied natural gas (LNG) projects. These projects relied heavily on large, imported plant and machinery manufactured overseas, artificially inflating productivity during that time. When those years are excluded, the picture becomes clearer: productivity has declined since the 2000s (by 6%), and productivity today is at levels comparable to the 1990s.

This long-term decline highlights structural issues that have persisted within the industry. Rising project complexity has added layers of difficulty to project delivery. The adoption of new technologies, which has positively impacted other industries, has been slower in construction, leaving opportunities for innovation untapped. At the same time, labour shortages, supply chain disruptions, and increasing regulatory requirements have compounded the pressure, creating headwinds that have held back productivity growth.

Despite these challenges, there is a path forward—one that builds on the recent gains and lays the foundation for sustained progress. Addressing labour shortages through targeted training and workforce development will be important. Embracing technological advancements—such as modular construction and digital tools—and more efficient project management practices can further enhance productivity. Meanwhile, fostering a more collaborative and less adversarial culture between stakeholders – particularly in contracting, procurement and risk management – will help unlock innovation which is the critical ‘X factor’ for productivity growth.

The 2% rise in construction industry productivity in FY24 is a welcome development given recent trends. However, there is still much work to be done to turn this statistical ‘bump’ into a sustained improvement in productivity performance. Given limited resources and the scale of investment required this decade across housing, transport, energy transition, water, health, education and defence, a deep focus by industry and government on improving the construction industry’s productivity performance is critical to meeting Australia’s economic, social and environmental policy goals.

In this context, collaborative initiatives like the NSW Government’s recent release of its Principles for Partnership with the Construction Industry offer promising signs of progress. This update to the NSW Government’s 10 Point Commitment to the Construction Industry (released in 2018) now includes focused efforts to better track and improve productivity on projects, alongside other measures aimed at fostering efficiency and innovation. Combined with the National Construction Strategy, currently being developed by Infrastructure Australia in consultation with industry stakeholders, these efforts create a more optimistic outlook for the construction sector. For the first time in years, there is a clearer path forward to sustainably reversing the industry’s productivity challenges.

Chart: Multifactor productivity index (2023 = 100)

Your Author

Ronal Kumar

Lead Economist

Ronal Kumar

Lead Economist

Melbourne, Australia

Ronal is responsible for the delivery of bespoke macroeconomic and commercial due diligence projects. He has experience in analysing and forecasting land registry volumes, port trade, property markets and construction in Australia’s transport, utilities and mining sectors. He previously managed various industry reports, including commercial and residential property reports and various infrastructure subscription products. Ronal has a strong interest in presenting ideas and stories through visualisations and analysing large and complex data sets.

More Research

Post

Roads Australia | Cost escalation pressures are easing but key risks remain for the roads industry

Leading infrastructure industry organisation Roads Australia's 'Industry Perspectives' column has highlighted analysis from Associate Director Adrian Hart & Senior Economist Thomas Westrup.

Find Out More

Post

From transport to energy – the impact of engineering construction cycles on the regional outlook

The Australian engineering construction industry is characterised by booms and busts of activity, not only by subsector and state but by regions within states and territories.

Find Out More

Post

Building Tomorrow’s Roads: Navigating Skills Shortages and Embracing Innovation in Infrastructure

The road infrastructure sector is facing a serious skills shortage, exacerbated by the impacts of COVID-19, increasing demands on transport projects, and rapid technological advancements.

Find Out More