Interest rates set to stay higher for longer in Australia

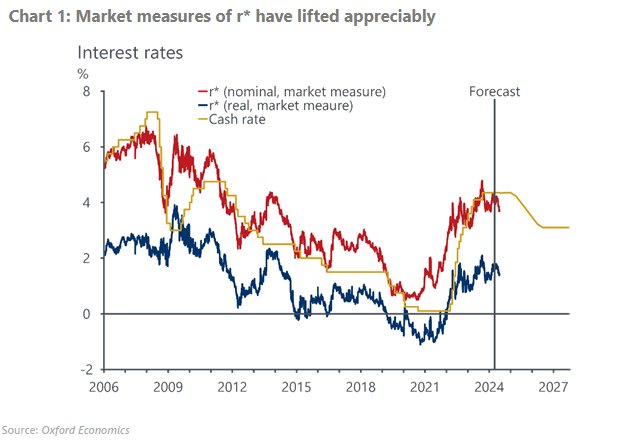

We have revised up our estimate of the neutral interest rate (r*) in Australia. r* was in a secular decline for several decades leading into the pandemic. But market-based measures have increased in recent years. We think the market overstates the extent to which r* has increased, but we do expect some of this increase to persist.

Australia’s neutral interest rate is in part determined by global forces. r* has increased in several advanced economies, which we attribute in part to higher public debt burdens. Our revision to Australia’s neutral rate follows an upward revision to our estimate for r* in the US.This change does not impact our expected timing for the RBA’s easing cycle – we still see this commencing in Q2 2025. But we now expect it to be a shallower cycle, with the cash rate settling at 3.1% in the long run.

Key points

- The neutral interest rate is an important concept for policy makers and market participants alike. It represents the level of the policy rate where monetary policy is neither expansionary, nor contractionary, and consistent with inflation at the RBA’s target. Given we do not have visibility on the business cycle more than a couple of years ahead, it is the level we expect interest rates to converge to in the long-run.

- But as with other equilibrium concepts like potential output and the natural unemployment rate, the neutral interest rate cannot be directly observed; it can only be inferred from the broader performance of the economy. There are several meritorious approaches to estimating r*, although each yield different results and carry uncertainty. Recent estimates presented by the RBA show their suite of models yield estimates that span around 80 basis points – and this range of estimates has narrowed considerably compared to the period leading into the pandemic.

Download the full research report to learn more.

Tags: