Mortgage stress is growing but limited in Australia

Stress among home loan borrowers has risen due to higher interest rates, broad cost-of-living pressures, and the gradual slackening of the labour market. While most households are well placed to weather current headwinds, some are struggling.

Fueled by elevated overseas migration and demographic trends, housing demand remains robust. Monthly new home lending values have increased 19% since the low point in early 2023, reflecting a rebound in property prices. The Australian Prudential Regulation Authority (APRA) reports that new lending practices are sound, with measures of risky lending — such as debt-to-income (DTI) ratios and loan-to-value ratios (LVR) — remaining close to historic lows. Although some countries, like New Zealand, have adjusted their macroprudential policies this year, we do not anticipate any significant changes in this area by APRA near term.

Key points

Access the research report to learn more about the key points outlined below:

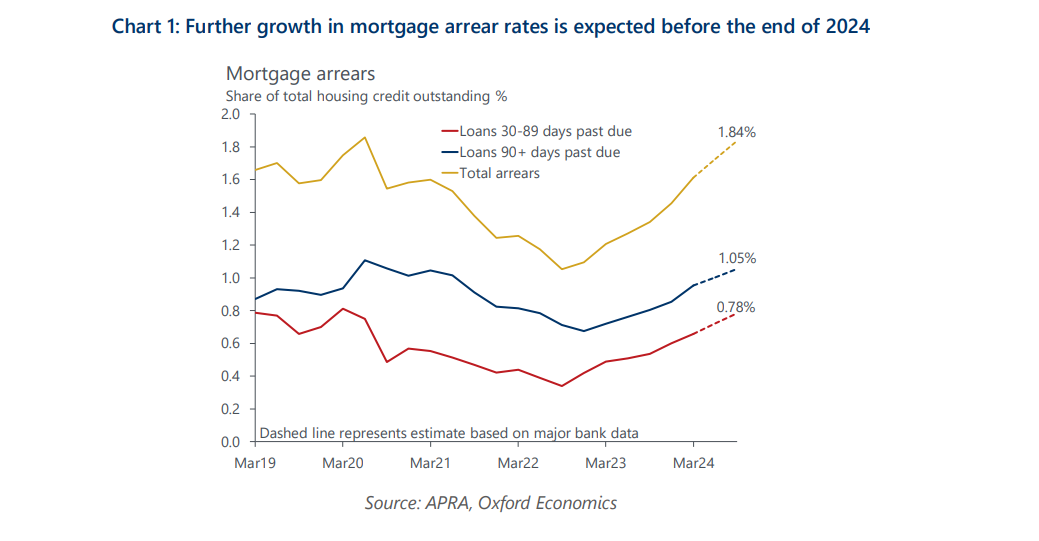

- Most borrowers are servicing their debts on time. Reflecting strong lending standards, high savings buffers, and low unemployment, housing loan arrear rates reached very low levels in FY2023. However, they have since increased. Highly leveraged, lower income households and recent first home buyers are most sensitive to adverse economic conditions.

- While job losses have typically been the primary cause of arrears, budget pressures from inflation and interest rates are the current key drivers. The full impact of rising unemployment on arrears is yet to be felt. With unemployment forecast to peak at 4.5% by the end of the year and the cash rate remaining higher for longer, we expect arrears to rise further to at least 1.84% of total outstanding housing loans — still a relatively small share.

- To date the housing market has absorbed the lift in arrears with demand outpacing supply in most markets. Looking ahead Australia’s chronic undersupply of dwellings will more than offset a lift in pressured sales due to arrears with the combined capital city median house price forecast to grow 5% over FY2025. However, risk is tilted to the downside. A greater deterioration in the jobs market than assumed would cause arrears to rise even further. Pressured selling would push property listings higher and weaken buyer confidence, resulting in a flatter profile for prices.

Tags: