Blog | 11 Mar 2025

Overcoming Scope 3 data challenges for global supply chains

Andrew Tessler

Head of Economic Impact Consulting, at Oxford Economics Australia

Climate change is creeping up on us – sustainability reporting is already here

Major Australian corporates face a new reality. Not only is climate change here but so – as from the start of this year – are new sustainability reporting standards.

Known as the Australian Sustainability Reporting Standard – or ASRS – these were introduced on 1 January 2025 and are aimed at informing investors and other stakeholders about a business’ current and future greenhouse gas emissions.

The standards are mandatory for many companies, though there is a staggered schedule base on company size, with major corporates ($500m+ p.a., consolidated revenue, 500+ employees or $1 billion+ in gross assets) becoming liable to report from 1 January 2025, an intermediate tier from 1 July 2026 and smaller ones ($50m+ p.a., consolidated revenue, 100+ employees, $25m+ in gross assets) reporting from 1 July 2027.

Now many corporates have been gradually implementing or upgrading their reporting in any case. However, even major corporates may find the reporting regime challenging.

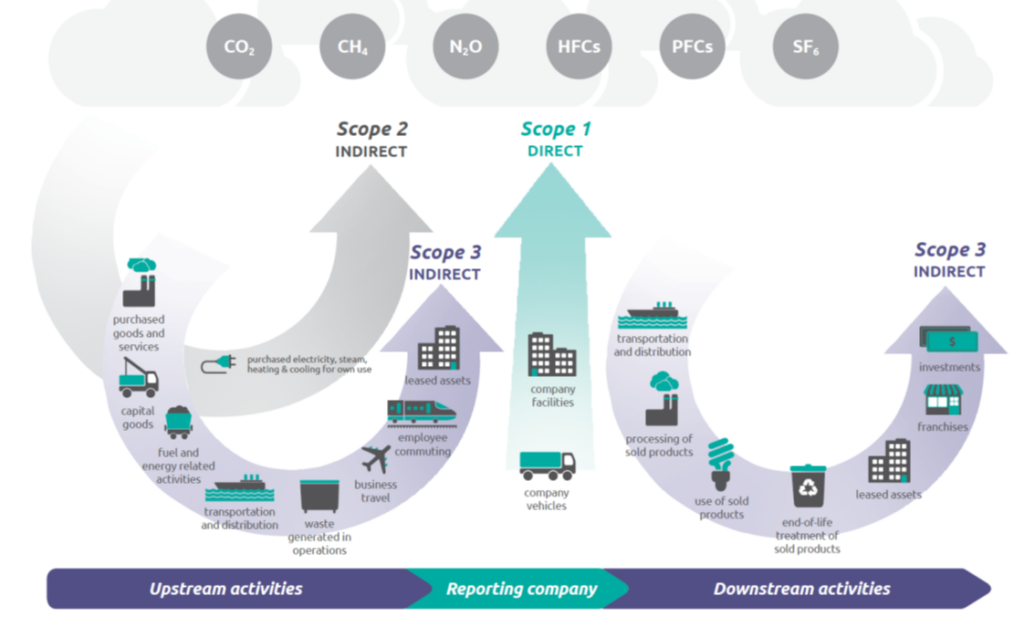

This is because the ASRS requires reporting of Scope 3 emissions. What are these? Well Scope 1 emissions are straightforward enough – these are the company’s own emissions, while Scope 2 are emissions from the energy it purchases from outside sources. However, Scope 3 emissions are those emitted by a firm’s purchases from its suppliers (so-called “upstream emissions”) as well as its sold products (“downstream emissions”). So, for say, a factory, everything from the emissions in purchased goods and services, the transport used to put them at the factory gate and even employee commuting to work is included in Scope 3. So is the transport of goods out of the factory and disposal of products.

Source: World Resources Institute and WBCSD (2011) Corporate Value Chain (Scope 3) Accounting and Reporting Standard

Obviously tracking Scope 3 emissions isn’t easy and their measurement has been the source of some debate – to say the least.

While larger corporates grapple with these themes, smaller companies are even more likely to need assistance in dealing with them. Oxford Economics has developed a suite of models aimed at tackling such questions, including those examining supply chain purchases as well as more bespoke solutions.

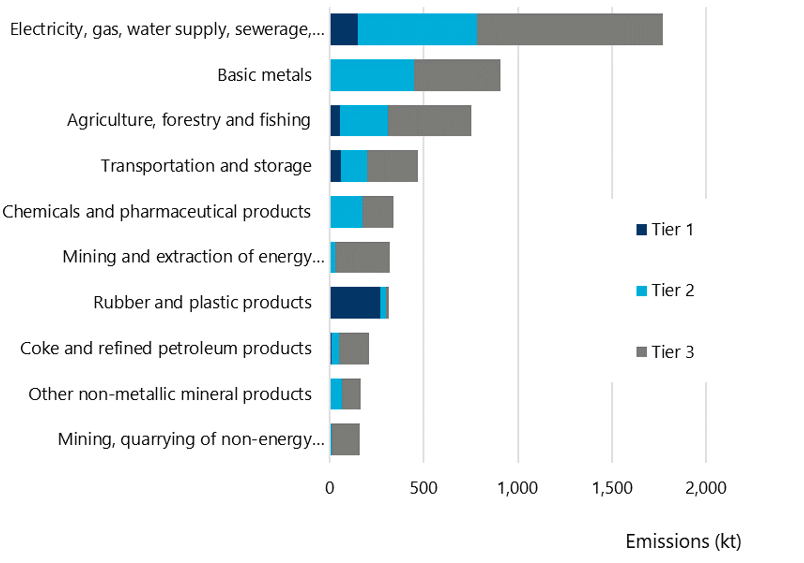

As an example, in the below diagram we examined how $18 billion in retail purchases could be measured in terms of Scope 3 emissions across the relevant supply chain (upstream emissions). The various tiers refer to whether the purchases are from suppliers (Tier 1), suppliers of these suppliers (Tier 2) or further down the supply chain (Tier 3).

As indicated, utilities (electricity, gas and water) are a big Scope 3 emitter for retail, followed by basic metals and agriculture.

Top 10 Sectors by Emissions

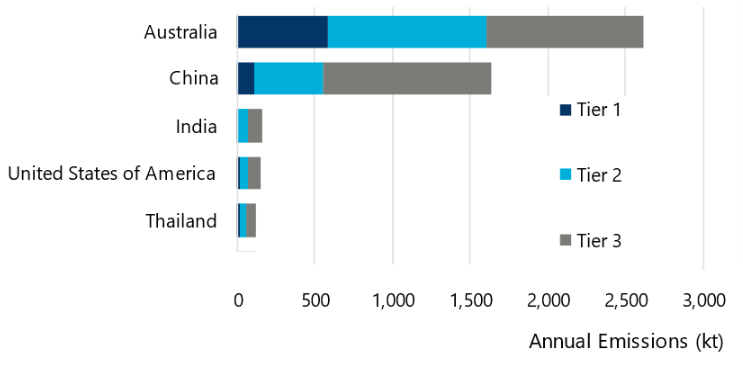

And the same thing can be done at a country level. Obviously, Australia is going to be chief Scope 3 emitter here, and perhaps not surprisingly followed by China, with the others following well behind.

Top 5 Countries by Emissions

Not only is this information useful for reporting purposes, it also sheds new light on what corporate supply chains actually look like.

While this analysis only covers upstream emissions, a variety of specialised methods are also available to tackle downstream one specialised basis. The take-away from all this is that, while assessing Scope 3 emissions may seem a daunting task to business at first, there is also an opportunity not only to assess them but to gain fresh insights onto company value chains.

Your Author

Andrew Tessler

Head of Economic Impact Consulting, at Oxford Economics Australia

+61 (0) 2 8458 4224

Andrew Tessler

Head of Economic Impact Consulting, at Oxford Economics Australia

Sydney, Australia

Andrew heads up Oxford Economics Australia’s applied economics consulting practice. He has 20 years’ experience as an economist and is a dual Australian/UK national specialising in transport economics, with international experience in the field. Andrew has worked at the NSW Treasury, Booz & Co (now PwC Strategy&) and Oxford Economics in the UK.

Projects I’ve worked on:

- The economic impact of Buy Now Pay Later in Australia

- Regulators globally are realising traditional finance and credit products need re-evaluation to determine how best to provide proportionate, scalable and targeted regulatory frameworks that balance payments innovation, consumer choice, flexibility and interoperability, while delivering high standards of consumer protection.

Cordor

- Regulators globally are realising traditional finance and credit products need re-evaluation to determine how best to provide proportionate, scalable and targeted regulatory frameworks that balance payments innovation, consumer choice, flexibility and interoperability, while delivering high standards of consumer protection.

More Research

Post

Economic Outlook Conference 2025: Shaping tomorrow: Economic growth pathways and a net zero future

It was fantastic to welcome our esteemed clients and guests to our economic forecasting conference in Sydney, Melbourne and online.

Find Out More

Post

Wage growth slows in Q4 – much to the RBA’s relief in Australia

Wage growth was restrained in Q4, rising by just 0.7% q/q. The y/y pace of wage growth has fallen to 3.2%, the slowest pace since the end of 2022.

Find Out More

Post

Broad based rise in exports lifts trade balance in November in Australia

The solid rise in the trade balance in November was largely driven by stronger export values.

Find Out More