The Coming Construction Upswing: Implications and Risks

It was a pleasure to welcome our clients to Australia's Construction Conference, hosted in Sydney, Melbourne, and online.

Sign up for a free trial

At Oxford Economics Australia’s Construction Conference, held in Sydney on Tuesday, 17th September, in Melbourne on Thursday, 19th September, and online on Wednesday, 25th September, Managing Director David Walker opened with a thought-provoking introduction, providing a clear overview of the key topics to be covered. The conference explored publicly funded transportation projects, which continue to drive domestic engineering construction activity, with a peak forecasted to exceed $37 billion in FY25. This infrastructure boom is expected to remain a significant contributor to the sector’s growth over the coming years.

Additionally, discussions highlighted the projected increase in housing supply in the latter half of the decade, with total dwelling completions expected to reach 220,000 in FY29. This upturn will be supported by policy shifts at both state and federal levels, alongside pent-up housing demand, creating substantial opportunities for residential building in the near future.

The presentations provided delegates an opportunity to take a deep dive into major sectoral topics, including Construction & Infrastructure, Real Estate, Housing, and Building.

Is the Australian economy out of the woods?

The Australian economy is facing strong cross currents that are making for a challenging outlook and environment for policy makers,” said Sean Langcake, head of macroeconomic forecasting for Oxford Economics Australia. “The labour market has defied a marked slowdown in activity, which is testing the RBA’s very patient approach to bringing inflation back to its target.

“Concurrently, a significant easing in fiscal policy will give the economy a boost, which is welcome for households, but less so for inflation hawks.”

There has been a small tick up in some confidence indicators, and retail sales were firm in July. But it is still difficult to say whether tax cuts will overcome cost of living pressures and drive a recovery in consumption, according to Oxford Economics Australia. Meanwhile, headline inflation will be very close to the top of the RBA’s target range by the end of 2024.

“But with utilities subsidies providing much of the disinflation impetus, the RBA will largely ignore the headline data,” said Langcake. “Given the RBA’s hawkish rhetoric, we don’t see rate cuts coming until Q2 2025.”

Productivity growth is a sharp focus for policymakers as any improvement will improve the inflation outlook. But Australia is once again in a productivity slump that deepened in Q2.

“We have become a little more bearish on the productivity outlook,” said Langcake. “Artificial Intelligence (AI) looms as a source of upside potential, but uncertainty around its impacts abounds.”

Download the presentation deck here.

Residential building at a turning point?

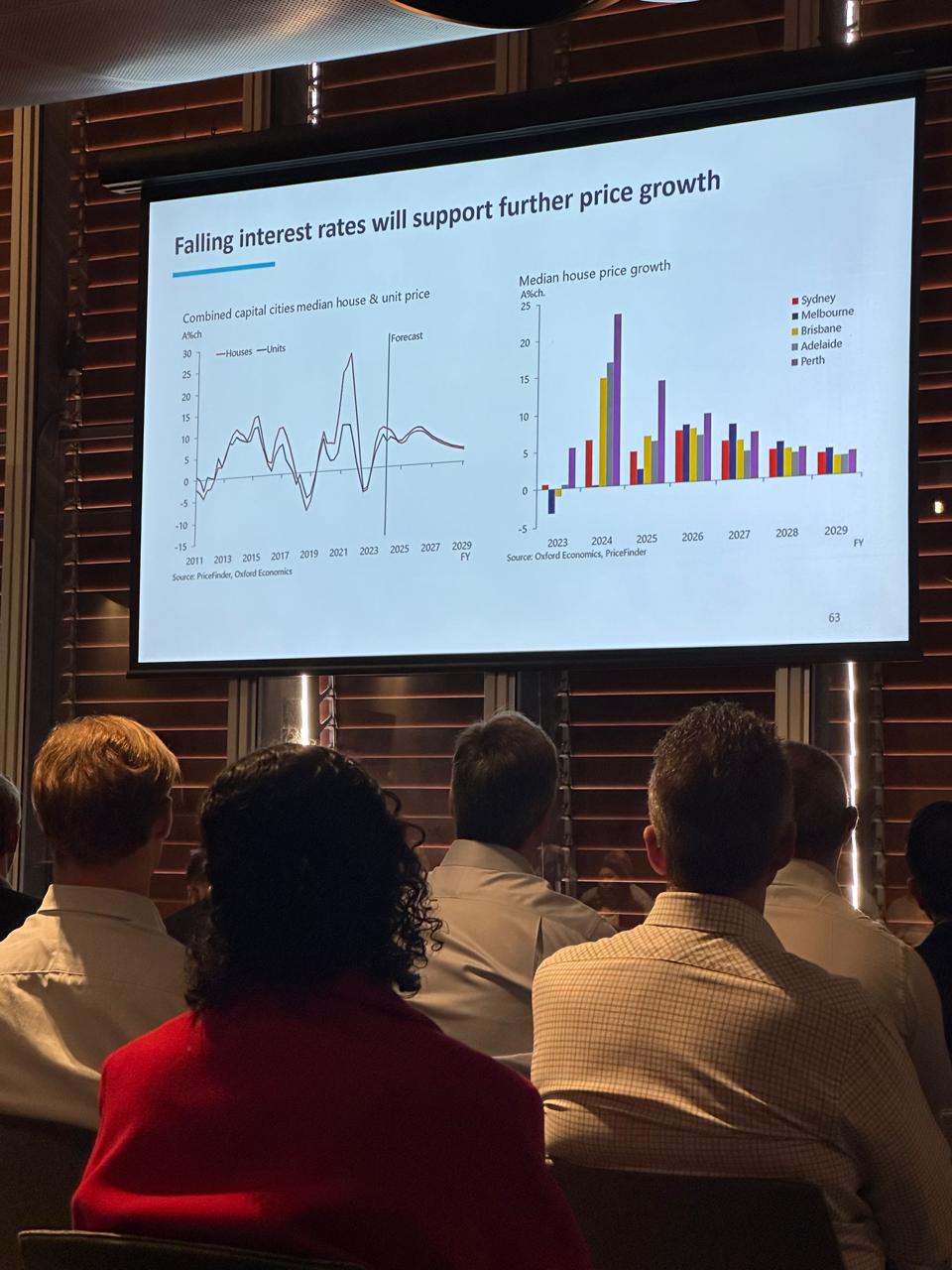

Higher construction costs and interest rates have dragged on housing demand and private investment. Delays and builder administrations have further suppressed the confidence of developers and home buyers alike.

“However, juxtaposed by strong population growth powering underlying demand, the Australian building sector is primed for a broad upturn once conditions become more supportive,” said Maree Kilroy, Senior Economist at Oxford Economics Australia. “Leading indicators suggest we are at the bottom of the cycle for key segments, particularly houses, though initial growth is expected to be modest.”

Oxford Economics Australia forecasts that a slowdown is looming for migration, with recent policy tweaks focused on international student flows expected to see net overseas migration halve from the current boom level to 250,000 by FY26.

Meanwhile, announced policy shifts at both the state and federal level, combined with substantial pent-up housing demand, cement a firm platform for residential activity to ramp up in the second half of the decade.

“We expect supply to climb in the back half of the decade, reaching 220,000 total dwelling completions in FY29,” said Kilroy. “However, industry capacity represents the most significant downside risk to the outlook for new housing. Persistent shortages of skilled trade labour will place a speed limit on the early-to-mid stage recovery. Construction insolvencies are expected to continue to surge over 2024, while issues with utility connections across our major cities may also act as a drag near term,”

Download the presentation deck here.

How much further can engineering construction activity grow?

“The publicly funded transportation boom has driven domestic engineering construction activity to record highs,” said Dr Nicholas Fearnley, head of global construction for Oxford Economics Australia. “As this boom comes to an end work will transition towards the utilities sector where investment is being spurred on by the move towards net-zero and long-term concerns around water security. A lot of this work will be done in regional areas, which will further test the industry’s capacity to deliver this work.

Oxford Economics Australia forecasts that work on the publicly funded transportation infrastructure book is set to peak at over $37bn in FY25. Total engineering construction activity will continue to grow over FY26, supported by growth in mining investment and the decarbonisation of the electricity network.

“Growing population and aging water assets have highlighted long-term concerns around water security,” said Dr Fearnley. “The water sector risks facing severe capacity challenges – particularly if drought conditions were to return – as it competes with both hydroelectric storage dams and hydrogen plants for skills, materials and equipment. “Growth in maintenance spending is slowing as the ramping up in LNG maintenance requirements comes to an end. Technological changes in both the electricity and telecommunications industries, and adoption technology to monitoring and maintaining assets are set to subdue maintenance spending across a number of asset classes.

Download the presentation deck here.

The Coming Construction Upswing: Implications and Risks

In the construction conference presentation, Adrian Hart discussed the weak national economy and low household spending, noting the absence or uncertainty of key investment drivers that have slowed construction growth. He highlighted a compositional shift in investment across sectors and regions.

On the engineering side, the transport cycle is nearing its peak, with growth starting in utilities and resources. On the building side, commercial and industrial activity is declining, though growth in the health sector offers some offset. The residential boom is still on the horizon. Over the next 12-18 months, construction is expected to remain flat as new engineering growth in utilities and resources is balanced by weaknesses in building, with the next major cycle likely to be driven by residential building.

Download the presentation deck here.

Summary

Oxford Economics Australia’s conference provided invaluable insights into Australia’s construction outlook for 2024 and beyond. With a focus on major sectoral topics including Construction & Infrastructure, Real Estate, Housing, and Building attendees gained a deeper understanding of the challenges and opportunities shaping Australia’s construction landscape with invaluable insights.

For more information about Oxford Economics Australia and our research capabilities, visit our website.

The Author

David Walker

Managing Director, Oxford Economics Australia

+61 (0) 2 8458 4234

David Walker

Managing Director, Oxford Economics Australia

Australia

David is the Managing Director at Oxford Economics Australia and heads the office for Australia and New Zealand. In August 2013 he moved to Sydney to establish the firm and is continuing to grow the business in this region as well as leading key projects within Australia.

Before moving to Australia David worked as part of Oxford Economics’ business development team in London. Prior to joining Oxford Economics he worked for KPMG as a management consultant, specialising in financial risk management including stress testing and scenario analysis. During this time he was also seconded to the main Financial Services regulatory body, the Financial Services Authority (FSA). He completed his degree in Economics at Nottingham University and also studied the chartered institute for securities investment diploma.