Data Insight | 01 May 2024

Retail sales slump as Swift effect fades

Ben Udy

Lead Economist, Macroeconomic Forecasting, Oxford Economics

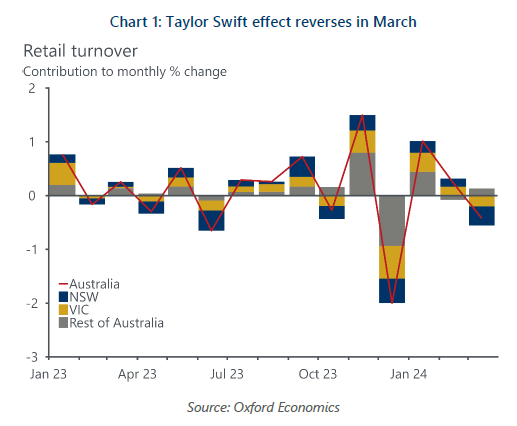

- Retail sales fell by 0.4% m/m in March following the boost to sales from the Taylor Swift tour in February. Sales are now up just 0.8% from a year ago and are broadly unchanged from September last year.

- We expect the broader outlook for consumer spending will improve this year as real wages continue to pick up. But for now, strong price inflation for essentials like health and education and higher rent and mortgage costs are still putting the squeeze on household budgets and discretionary spending.

Retail sales fell by 0.4% m/m in March led by declines in New South Wales and Victoria, following the boost in sales in those states in February from the Taylor Swift concerts. Outside of These states, average retail sales edged higher in March. (Chart 1) Spending on clothing & footwear, and at cafes & restaurants were down 4.2% m/m and 0.5% m/m respectively unwinding the boost to spending on merchandise and meals out during the concerts. Food retailing was the only category that increased in the month, up 0.9% m/m supported by continued strength in population growth.

Total retail sales values in Q1 were unchanged from Q4. Considering the 0.6% q/q rise in market goods prices in Q1, the volume of retail sales likely declined in Q1. Next week’s real retail sales data will provide a better guide on this front. Still, we suspect rising services consumption will see overall consumption continue to add to GDP growth in Q1.

The underlying trend in retail spending remains very weak, with spending up just 0.8% on a year earlier, the weakest annual pace of growth on record outside the pandemic. Considering the brisk pace of population growth, this is a very soft trend. Last week’s CPI data spurred concerns that the RBA may yet need to raise rates again to rein in inflation. But these data are a further confirmation that consumer demand is very restrained at present.

Your Author

Ben Udy

Lead Economist, Macroeconomic Forecasting, Oxford Economics

+61 (0) 2 8458 4200

Ben Udy

Lead Economist, Macroeconomic Forecasting, Oxford Economics

Sydney

You might also like

Service

Australian Retail Property Forecasting

Detailed analysis and forecasts for Australian retail property markets.

Find Out More

Post

Australian property risk premiums rising but will remain below average

Australian bond yields have risen over the past 18 months, highly influenced by movements in the US, reflecting more hawkish expectations for policy rates and a higher term premium. As is the case overseas, we think that markets are currently overstating where policy rates will ultimately settle and expect bond rates will come back from their current level in time.

Find Out More

Post

With interest rates nearing a turning point, where to for Australian real estate?

The run up in interest rates has provided a drag for all asset classes, but other cyclical and structural drivers are becoming more prominent in determining performance.

Find Out More