News | 15 Nov 2023

Strong wage growth in Q3 keeps pressure on the RBA

Ben Udy

Lead Economist, Macroeconomic Forecasting, Oxford Economics

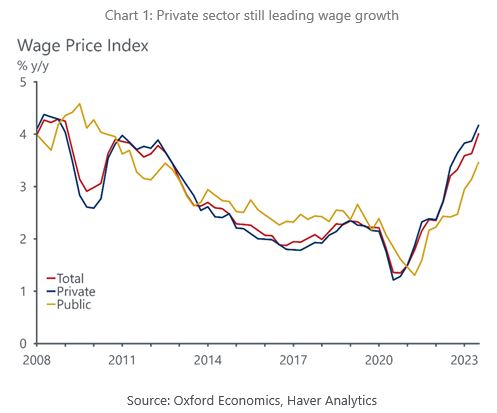

- The Wage Price Index (WPI) increased by a sharp 1.3% q/q in Q3 – the largest quarterly growth on record – taking the y/y pace of growth to 4.0%. The jump in wage growth was partly driven by the larger the usual 5.75% increase in award wages implemented in July.

- The RBA was already braced for a very strong Q3 number, so today’s data will not come as an upside surprise. Even so, we don’t think the November hike will be an isolated one, and today’s data highlight the ongoing inflationary pressures in the economy, supporting to the case for another hike in December.

Wage growth had settled at 0.8% q/q in each of the past three quarters. But unseasonably large Q3 increases, and an increase in the share of jobs with a wage change, saw growth jump to 1.3% q/q. Growth was led by private sector wage growth (1.4% q/q), while public sector wage growth was also brisk at 0.9% q/q. Q3 was a perfect storm for wage pressures, the labour market remains in a very tight position, and limited capacity is generating faster wage growth. High CPI inflation is also factoring into wage decisions as workers seek to keep up with cost-of-living pressures. Lastly, the Fair Work Commission’s larger-than-usual increase in minimum and award wages on from 1 July had a large impact on wage growth in Q3.

Those factors translated into strong wage growth across each pay setting method. Individual agreements, which are most sensitive to labour market conditions, matched the pace of growth in Q3 last year. The Fair Work Commission’s decision predictably drove a large increase in award wages. This decision also routinely spills over to enterprise bargaining agreements (EBAs). Growth was also by a significant 15% increase in wages for eligible health care and social assistance workers in the Q3.

While the larger the normal increase in award wages driven by the Fair Work Commission’s decision may be a one off, the labour market is still tight, inflation is still high and intense EBA negations are continuing. We suspect wage growth has now peaked, but these factors will keep pressure on wage growth in the months ahead. The RBA was already expecting a strong Q3 WPI print, so today’s data won’t present an upside risk to their November forecasts. However, it does highlight the breadth of inflationary pressures still present in the economy, supporting the case for a December rate hike.

Contact us

If you would like to find out more about any of our services, please fill in the form and let us know a bit more about you and what you’re looking for. A member of the team will be in touch with you as soon as possible.

By submitting this form you agree to be contacted by Oxford Economics about its products and services. We will never share your details with third parties, and you can unsubscribe at any time.

Technical issues with My Oxford?

If you are having a problem with the My Oxford platform, including issues logging in, please contact the support team.

Alternatively, you can visit Oxford Economics’ help and support page.

Brent Stadus

Business Development Manager

+61 423 423 046

Brent Stadus

Business Development Manager

Sydney, Australia

Brent is part of the Sydney-based business development team where he is responsible for growing the client portfolio across Australia and New Zealand. Having diverse experience across a range of industries including the financial services sector, Brent specialises in assisting financial institutions to improve their strategic decision-making capabilities. When not at work, you will typically find him at the beach.

Explore our services

Service

Australia Macro Service

The Australian Economic Forecasts provides in-depth insights and analysis of key domestic and global trends.

Find Out More

Service Category

Consulting Services

Our consulting team develops bespoke solutions to help clients tackle their most important issues. The team applies economic frameworks and our proprietary models to complete more than a hundred projects every year for local and global organisations.

Find Out More

Service Category

Subscription Services

A comprehensive portfolio of Australian economic reports, databases and analytical tools on a subscription basis

Find Out More