Research Briefing

| May 29, 2024

The impact of office conversions and demolitions

The conversion of underutilised low-grade office stock to residential dwellings is pushed as a carbon effective path to boosted housing supply and a more balanced office market. While a winwin in concept, in practice development potential is significantly limited.

Access the research report to learn more about the key points outlined below:

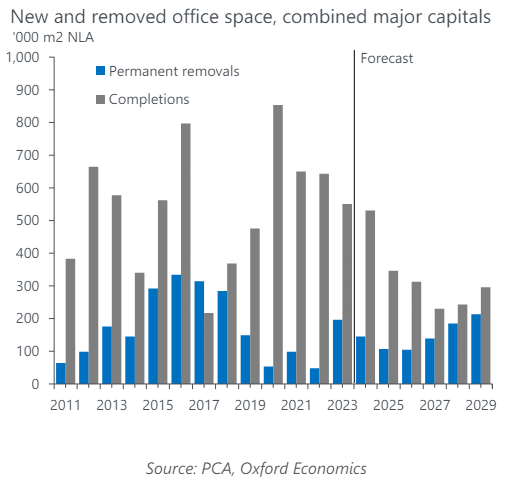

- Following a jump in demolitions for Sydney Metro West stations, removals are expected to taper to 107,000m2 of net lettable area (NLA) in 2025. We expect trend growth from here but in an environment of elevated build costs, traction will be slow to gain. With transport related demolitions to rebase lower and a subdued outlook for office redevelopment, transition to residential, accommodation, and education use shape the outlook.

- Backed by easing interest rates, a policy tailwind, and considerable pent-up demand, an upturn in apartment construction is projected to begin showing through in 2025. Historically, residential conversion activity comes through late in the cycle. Absent targeted policy intervention, we expect this dynamic to hold, with residential transition activity ramping up from late 2027.

- Withdrawals play an understated role in balancing the office market. They are forecast to rise above 200,000m2 by 2029 – well down on the 2016 peak of 344,000m2 . With a slim pipeline of mooted office towers, we see this sitting just below oncoming supply. Demand challenges aside (hybrid working, AI etc.), a very small growth increment for the office stock towards the end of this decade points to a tightening market, with robust gains in rents and capital values to follow.

Tags: