Research Briefing

| Jul 7, 2024

Why speculation over a rate hike is wide of the mark in Australia

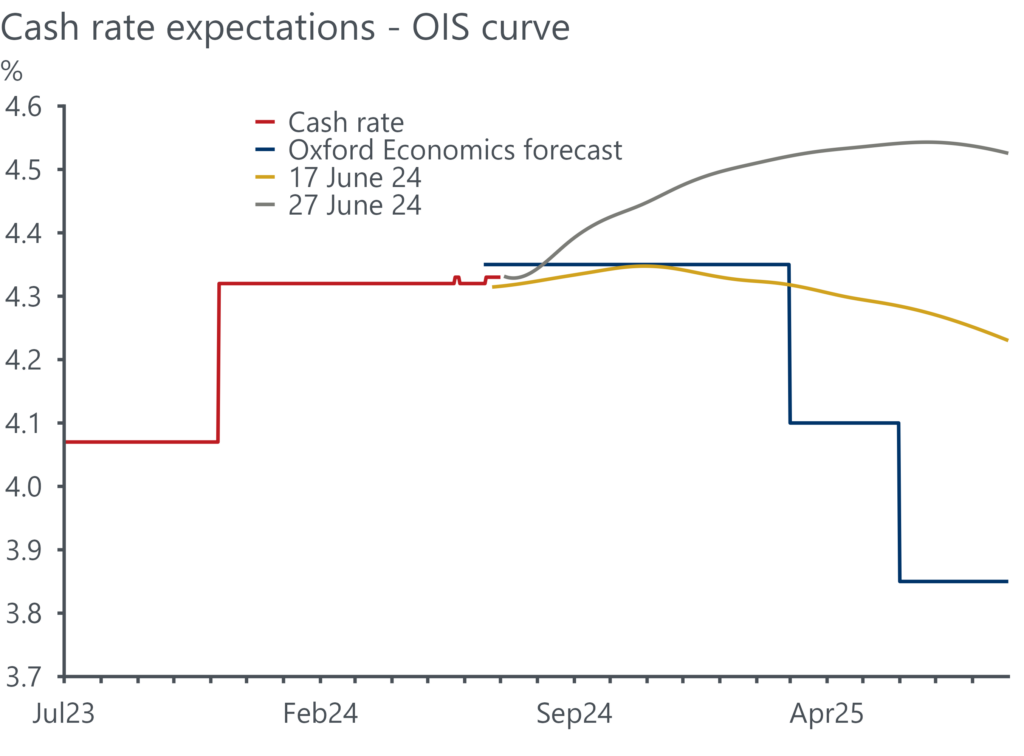

Following hawkish comments from the Reserve Bank of Australia and a rise in CPI inflation readings in the last two months, markets have increased their bets on the probability that the RBA will hike interest rates at its next meeting in August. We think this speculation is overblown.

Access the research report to learn more about the key points outlined below:

- The monthly inflation indicator gives a noisy signal of underlying inflation pressures, and the recent increases appear to have been largely caused by unfavorable base effects. Even if inflation does surprise to the upside in Q2, Q3 will be a weak print due to cost-of-living subsidies. Given the long time frame the RBA has set itself for returning inflation to target, we expect they will stay the course and keep rates on hold.

- Strong market reactions to any perceived hawkishness are understandable given the case for tighter policy settings is strong; inflation is above target and the disinflation cycle is losing steam, while the labour market is around full capacity. But absent a drift in inflation expectations, a hike would be a substantial departure from the reaction function the RBA have established.

- We maintain our forecast that the RBA’s next move will be a rate cut, which we have penciled in for February 2025.

Tags: