Blog | 14 Oct 2024

Engineering construction – June quarter data reveals a changing of the guard

Ryan Lee

Economist

Engineering construction – June quarter data reveals a changing of the guard

Amid a relatively weak building sector (particularly for residential building), engineering construction continues to provide growth support for the broader construction industry.

While growth continues to normalize from recent peaks, the most recent engineering construction work done data (for the June quarter of 2024) shows some strength still remains. In real seasonally adjusted terms, work done in the sector grew 1.2% over the June 2024 quarter, compared to March 2024, and was 5.7% higher than in the June quarter last year.

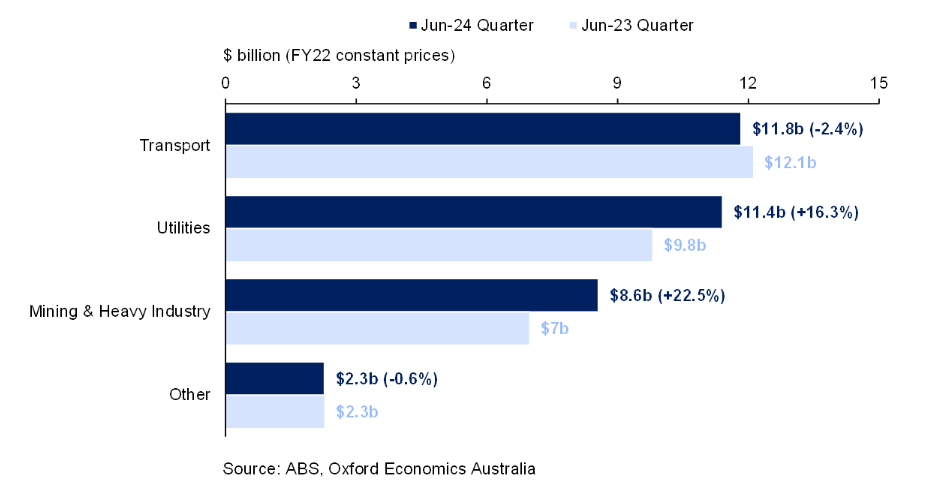

At a national level, there has been a compositional shift in the source of construction growth. While the transport cluster (roads, railways, bridges and harbours) remains the largest sector, a 2.4% year-on-year decline in the latest data continues on from a similarly weak March quarter. This represents a sharp decline from the 21.6% year-on-year growth observed just last year.

By contrast, the June quarter sees further ‘catch-up’ from the utilities cluster (electricity, water, sewerage, and telecommunications), with the sector growing 16.3% since the previous year to reach construction levels almost on par with transport, a milestone not observed since June quarter 2020 (when Australia was in the midst of an electricity boom to meet the 2020 Renewable Energy Target). Meanwhile, mining and heavy industry construction has continued its strong run of form, with work done growing a robust 22.5% year-on-year and achieving its sixth consecutive quarter of year-on-year growth.

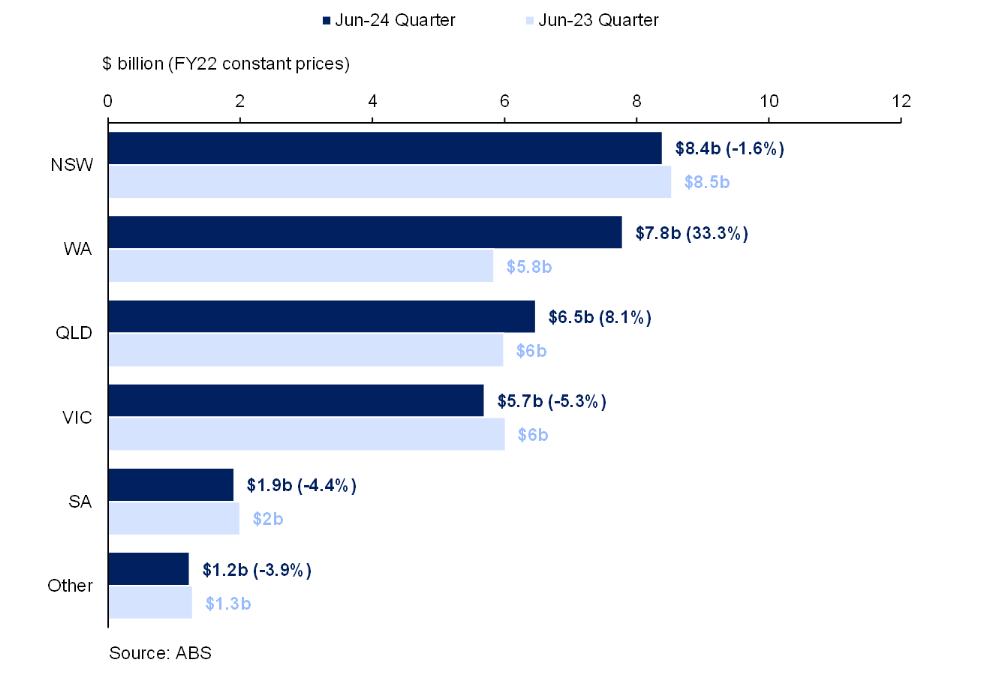

A shift in momentum is also observable at the state level, with New South Wales (and to some extent Victoria) witnessing a sharp deceleration in growth while growth is picking up in Western Australia, the Northern Territory and (albeit somewhat underwhelmingly so far) Queensland.

In real year-on-year terms, New South Wales recorded a 1.6% decline in engineering construction activity, the first contraction in almost three years. Victoria has exhibited a similar trend (although slightly further along), continuing its previous quarter’s sharp reversal with a 5.3% decline compared to last year. This decline is being driven by the beginnings of a ‘normalisation’ in transport investment in these states, with transport construction work done falling 2.7% and 5.7% year-on-year in New South Wales and Victoria respectively. Activity levels still remain at historic highs as both states continue to invest in transport infrastructure. However, a declining pipeline of work and weak commencement activity suggests the transport-led infrastructure boom may be reaching a turning point.

In contrast, work done in Western Australia has continued its upward surge, with real construction activity now 33% above June quarter 2023 levels. Nominal activity has been supported by the ongoing post-COVID recovery of the mining and heavy industry sector (+39% year-on-year), with a healthy backlog of work still yet to be done. Significant investment in the electricity sector under the PoweringWA policy and efforts to improve the state’s water security is now also beginning to be translated into construction activity, with utilities work done growing 65% year-on-year in nominal terms and robust commencements (+22% year-on-year), particularly from public funding, pointing towards maintained strength in coming quarters.

At Oxford Economics Australia, the June quarter outcomes were not beyond our expectations. We expected national engineering construction growth to moderate through FY24 as key growth drivers shift gears and this indeed appears to have been the result. Beyond this, we still expect to see a near-term boost in New South Wales and Queensland as the transport boom reaches its peak.

While there is certainly some cause for optimism in parts of the engineering construction market, we remain cautious of the downside risks. Growth in construction costs has eased, but they remain much higher than just two years ago. Skills shortages continue to hamper the ability to deliver on work. Record levels of transport construction, combined with strengthening utilities and mining investment, are creating competition for resources. More broadly, structural and geopolitical headwinds from China’s economy and the escalation of conflict in the Middle East may also weigh on the outlook for global growth and investment, with implications for the construction industry.

Your Author

Ryan Lee

Economist

Ryan Lee

Economist

Sydney, Australia

More Research

Post

Roads Australia | Cost escalation pressures are easing but key risks remain for the roads industry

Leading infrastructure industry organisation Roads Australia's 'Industry Perspectives' column has highlighted analysis from Associate Director Adrian Hart & Senior Economist Thomas Westrup.

Find Out More

Post

From transport to energy – the impact of engineering construction cycles on the regional outlook

The Australian engineering construction industry is characterised by booms and busts of activity, not only by subsector and state but by regions within states and territories.

Find Out More

Post

Is the Australian Economy out of the woods?

It was fantastic to welcome our esteemed clients and guests to our economic forecasting conference in Sydney, Melbourne and online.

Find Out More