Affordability pressures driving varied market performances

Residential Property Prospects l Australia

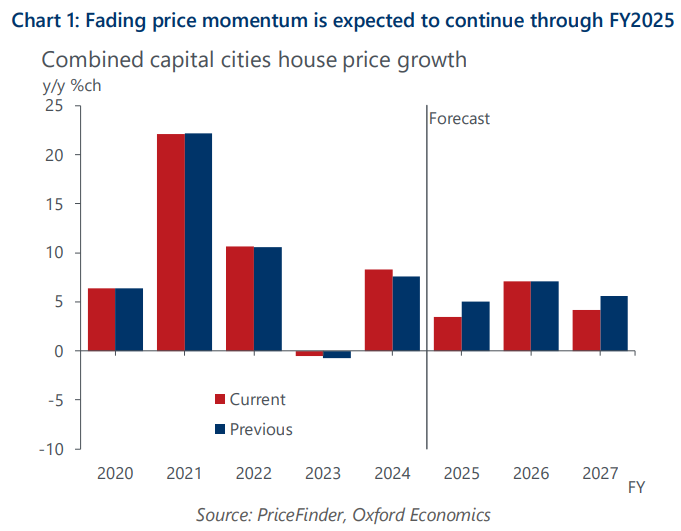

◼ Through a period of higher but stable interest rates and cost of living pressures, the combined capital city (CCC) median all-dwelling price grew 7.5% over FY2024 to a fresh record of $987,600. Relatively low unemployment, strong population growth, and a constrained new dwelling supply pipeline propped up demand for established properties.

◼ Mortgage affordability has deteriorated significantly and is testing new limits. In addition to rising listing volumes, this is curtailing price growth in most markets. The first cash rate cut by the RBA is not anticipated until June quarter next year. Hence, we expect the median all-dwelling price to increase by a softer 3.8% in FY2025.

◼ The rate-cutting cycle will bring much-needed relief to mortgage holders and prospective buyers.We forecast all-dwelling prices will increase by 7.2% in FY2026, with units likely outperforming houses. However, a higher terminal cash rate of 3.1% is now expected. This is 50bps higher than assumed in our July update, taking some stimulus out of FY2027 (+4.4%).

To know more download the full report.

Tags: