Blog | 15 Feb 2024

2024: Shifting infrastructure priorities…but capacity issues remain

Adrian Hart

Director, Construction and Infrastructure, Oxford Economics

Calendar 2024 marks a turning point in the construction and infrastructure industry in Australia, with total construction work done expected to fall in real terms through the year for the first time since 2020. However, much of the weakness in the industry is centred on residential and commercial building. Civil and social infrastructure activity continues to grow apace. The long boom in transport construction is now giving way to a new wave of investment in utilities, social building and resources infrastructure which will present regional challenges. Overall, the sheer scale of activity forecast for 2024 remains a challenge. With global supply chains improving through 2023, the shortage of local skills in the industry now remains the most critical constraint to infrastructure delivery.

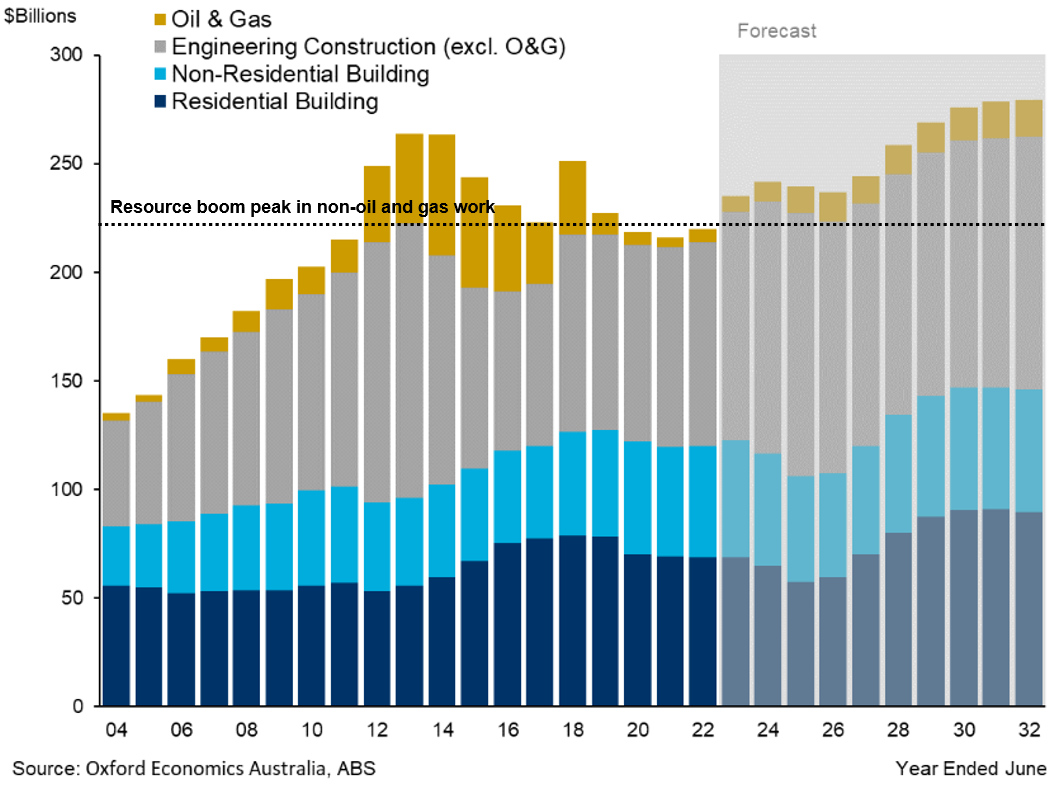

Fig. 1 Value of Construction Work Done, Australia, $Billions, Constant 2021-22 Prices

Source: Oxford Economics Australia, ABS

As per the above chart, I track non-oil and gas construction as a quick way of identifying local demand-side risks to infrastructure delivery. On this measure, Australia is currently exceeding the level of work done at the peak of the resources boom – and it will get much busier in the second half of this decade.

Unfortunately, market capacity risks are expected to remain with us for a long while yet. Even with some expected easing in transport-related works in coming years, public and private investment in infrastructure in aggregate is not easing up anytime soon. Australia remains in ‘catch up’ mode in terms of delivering the infrastructure we need for our fast-growing population, to improve connectivity, productivity and competitiveness, to meet our environmental goals and to make our infrastructure more resilient to the effects of climate change that is already ‘baked in’. In this context, a looming synchronised upturn in construction work across residential building, non-residential building and engineering construction in the second half of this decade presents significant risks to both industry and government procuring agencies.

We need to face the challenges confronted by industry and governments which continue to constrain the delivery of investment in productive infrastructure – and start delivering on solutions. Failure to do so will perpetuate the negative consequences observed by many in the industry today: cost blowouts and cost escalation (they are different beasts with different causes), project delays and project (and business) failures which impact on infrastructure quality and value for money, not to mention the very real human costs to those who work in the sector. Demand side management – as attempted by the 90-day Infrastructure Review – is hard, but implementing longer-lasting reforms will be even harder to achieve: these will need to address our poor productivity performance over the past three decades and growing our local skills base to meet the demand-side challenge. (More on this in future blogs).

Finally, I’d like to add that 2024 holds another milestone for us. It marks the 60th year of continuous operations of Oxford Economics Australia (formerly BIS Shrapnel) in Australia since its beginnings as Philip Shrapnel and Co in 1964. Now part of the global Oxford Economics Group founded in 1981, Oxford Economics Australia continues to provide the best combination of market research, analysis, forecasting and advice for the construction and infrastructure industry and the broader economy. We understand the importance of the industry at the macro and microeconomic level and take the time to analyse the industry project by project (bottom up) but integrated with a view to macroeconomic (top down) constraints and challenges.

Understanding the challenges of this important sector – and providing rigorous analysis, forecasts and solutions for our public and private sector clients – is what drives our team. We look forward to connecting with you and providing further insights through 2024.

Your Author

Adrian Hart

Director, Construction and Infrastructure, Oxford Economics

+61 (0) 2 8458 4233

Adrian Hart

Director, Construction and Infrastructure, Oxford Economics

Sydney, Australia

Adrian has over 25 years of economic analysis and consulting experience with Oxford Economics Australia, focusing on the infrastructure, building, maintenance and mining industries. Adrian has undertaken a wide range of consultancy projects for the public and private sector based on his detailed understanding of construction, mining and maintenance markets, their drivers and outlooks, the range of organisations operating in this space and the issues they face. This work includes deeper industry liaison, contractor and competitive analysis, pipeline analysis, demand and cost escalation forecasting, and industry capacity and capability projects for the public and private sector. He is the lead author of major reports but also undertakes briefings and workshops for senior management, board members and industry associations, leads in-depth stakeholder consultation, and facilitates and chairs roundtables between government and industry.

More Research

Post

Australian Non-residential building major project outlook for 2024

A pipeline of major projects (contract value at or above $50 million) totalling $15.4 billion nationally is expected to break ground in calendar year 2024

Find Out More