Research Briefing

| Jul 11, 2024

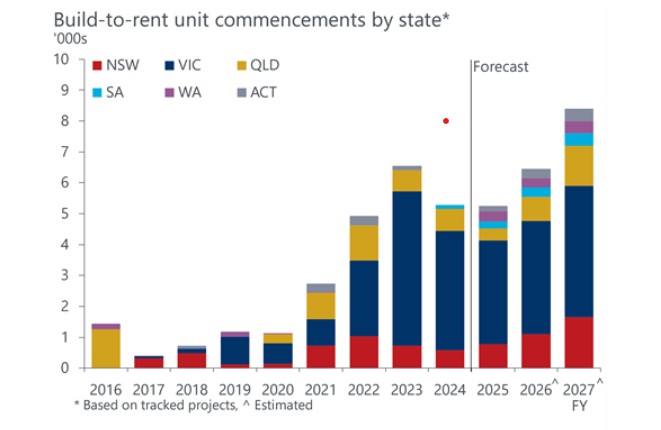

Build-to-rent takes a temporary step back in Australia

Following a strong FY2023, the past year has proven more difficult for the build-to-rent (BTR) sector. Unit commencements fell 19% to 5,290 in FY2024, with financing issues the core driver of this lull. Borrowing costs remain high, while institutional capital (particularly from overseas) has been harder to access given uncertainty around key policy tweaks.

Access the research report to learn more about the key points outlined below:

- Variation continues to play out by city. Melbourne remains the hotspot, with Sydney and Brisbane following at a distance. Adelaide has picked up its first institutional development in the past year while Perth has been stung by construction capacity issues.

- Across more than 280 projects, our project tracking captures a pool of circa 77,750 dwellings – near 14,000 of which are currently under construction. There are 7,216 units due to be completed in FY2025, with several developers set to see their first project come online. Once these assets approach stabilisation, we expect to see them move on with their next round of developments.

- Although development sites are beginning to transact between BTR operators, we are yet to see any real signs of a market consolidation – a process likely slowed by a lack of fully operational platforms. Meanwhile, traditional build-to-sell (BTS) developers continue to see BTR as a potential pathway to getting projects underway. This can be achieved through shifting a component to BTR or selling the entire site to a BTR provider.

Tags: