Australian population growth to temper but remain hot in 2024

Net overseas arrivals hit a record 328,460 in Q1 2023 as students arrived for the start of semester one, before softening to 284,520 in Q2 – in line with historical seasonality. Travel movements data remained strong in the September quarter with total permanent and long-term arrivals roughly 40% higher than the same period in 2019 at 284,530. This supports the case for a strong Q3 NOM result, buoyed by the start of semester two.

Skilled, visitor, and working holiday maker visa volumes have all rebounded. Nonetheless, the student channel dominates, surging on the back of the underlying growth profile for the international student market, combined with stored demand from border closures and increased working rights. Further support is coming from what remains a favourable Australian Dollar.

What you will learn:

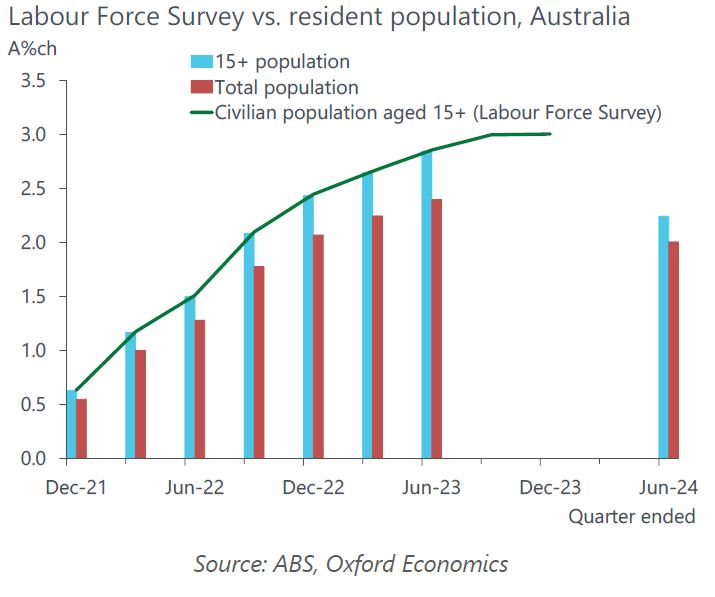

- The civilian population aged 15 years and over (estimated as part of the Labour Force Survey) provides a solid steer as to where the population growth rate will end up by December. Currently, it supports the case for near-term upside. Running at 3% y/y nationally to November, it points firmly towards robust Q3 and Q4 migration results.

- The growth spurt for temporary migration represents a boon for service exports and should lower heat in some pockets of the labour market. However, it also adds to pressure on infrastructure, most notably housing, which is positioned for a sustained undersupply holding deep into the back half of the decade.

- It is anticipated that NOM will total a still elevated 410,000 in FY2024 given continued strength in temporary migration. Further out, it is forecast that NOM will taper back to 250,000 per annum by FY2027. This forecast profile is stronger than that published in October, adding a cumulative 93,000 people to the NOM outlook.

Tags: