Research Briefing

| May 29, 2024

Australia’s non-residential building approvals set a weak lead

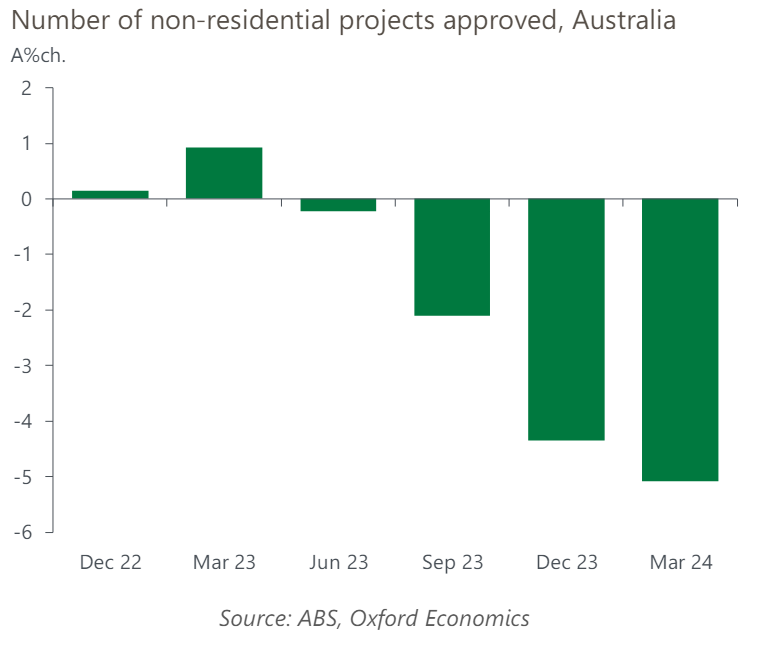

The approvals lead for non-residential building continues to soften, with March quarter 2024 maintaining the recent downward trend in project approvals. While a normalisation beyond COVID continues to impact for some sectors, broader cyclical demand drags are becoming more obvious.

Access the research report to learn more about the key points outlined below:

- In value terms, approvals have been volatile over the past couple of years. We note the presence of strong build cost inflation is increasingly impacting; as such it is becoming more valuable to look at the number of projects approved to get a sense of underlying momentum.

- The ABS publishes data on the number of non-residential projects approved each month, which we have seasonally adjusted to account for usual periodic variations. Non-residential project approvals fell to 8,222 in the March 2024 quarter (-5.1% y/y). This has played through across all value ranges, with the $20-50 million band seeing the largest annual fall as the number of approved projects slumped to 78 (-17%).

- The decline has been led by the private sector, with the number of commercial & industrial projects approved slipping by 7.3% y/y to 5,852 in Q1 2024. Public building also fell, although more marginally to 2,274 (-3.2%). Western Australia has bucked the national trend as the only major state to record y/y growth in Q1 (+3%).

Tags: