Research Briefing

| May 3, 2024

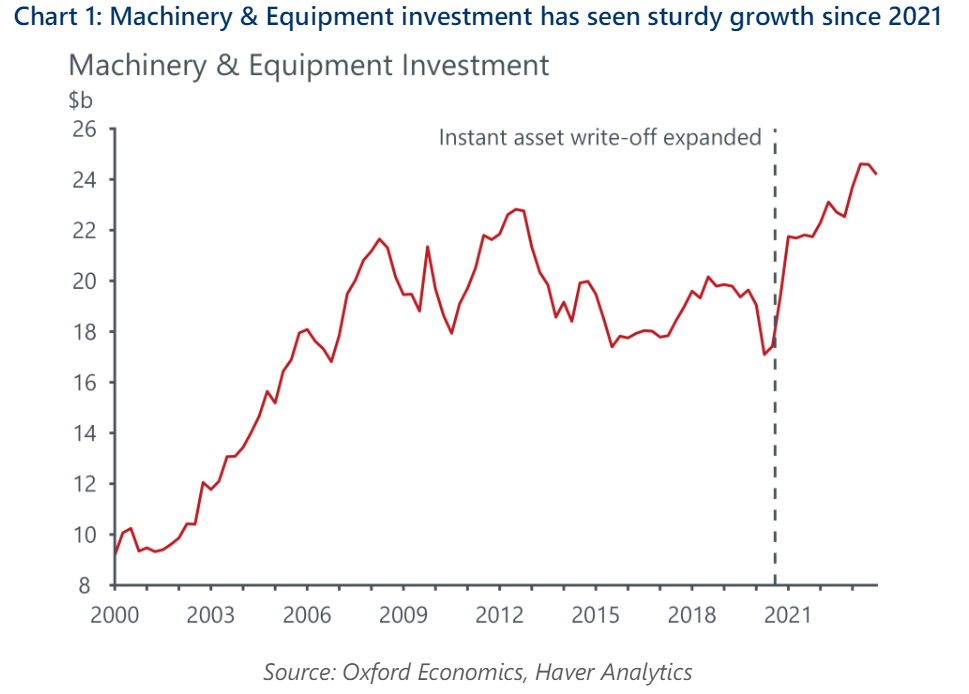

Machinery & equipment investment surge to wane in 2024

Following a long period of stagnation, machinery & equipment investment has experienced strong growth since the start of 2021 (Chart 1). At the end of 2023, real expenditure was around 30% higher than the average over the past decade and had surpassed the previous peak recorded during the mining investment boom in the early 2010’s.

- Business investment in new machinery & equipment has surged over the past few years. Pandemic-era fiscal incentives helped support capital expenditure, while extended delivery times due to supply disruption helped prolong the cycle throughout 2023.

- Activity will be much more subdued in 2024. Tax incentives led to a significant pull-forward of expenditure plans, and there is now an overhang that will weigh on activity. This weakness is evident in forward indicators of investment demand; capital goods imports have softened, and business surveys are also pointing to weakness ahead.

- Firms’ expectations for nominal expenditure on machinery and equipment are still very strong for FY25. However, we think this reflects higher expectations for costs, rather than a marked increase in the volume of investment to be undertaken. Cost inflation is slowing, but is still very brisk, with the machinery and equipment deflator up 7.4% y/y in Q4 2023. These cost pressures will contribute to anaemic growth in machinery & equipment investment this year.

Tags: