Modelling the global impact of a Trump comeback

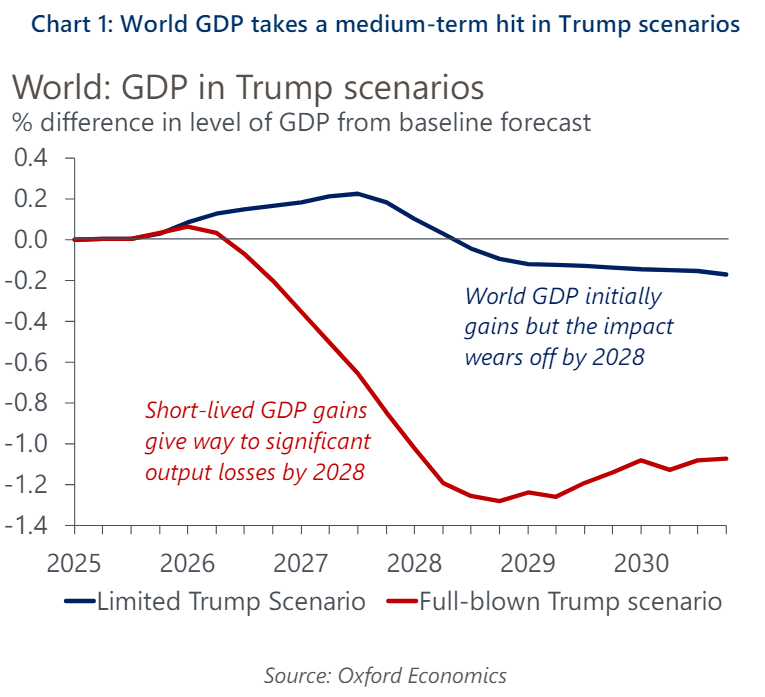

Two scenarios in which former President Donald Trump returns to the White House in the 2024 election show global GDP taking a medium-term hit of 0.2%-1.3% after some short-term gains.

In a ‘limited Trump’ scenario, the global impact is relatively mild. Looser US fiscal policy initially drives global growth higher before the effects of higher tariffs and a US growth slowdown pull world GDP down. In a ‘full-blown Trump’ scenario, the global effects are more severe due the combination of sharp rises in protectionism, higher interest rates, lower commodity prices, and a weaker US economy.

A key difference between the two scenarios is US tariff policy assumptions. In the ‘limited Trump’ scenario, only modest tariffs are implemented and their impact on world trade is offset by stronger US growth. In the ‘full-blown Trump’ scenario the US weighted average tariff rises by over 6ppts and this contributes to world trade dropping by 6% relative to baseline by 2030.

The report expands on the impact various US election scenarios:

- Similarly, impacts on US interest rates, the dollar, and commodity prices are mild in the ‘limited Trump’ scenario, but much more marked in the ‘full-blown’ scenario, in which the dollar’s peak gains are 3%, US 10-year yields rise 60bps, and commodities prices fall over 10%. The financial market disturbances in the ‘full-blown’ scenario add to downside effects on world growth.

- In the ‘limited’ scenario, China is the biggest loser, but the GDP loss is quite small and some economies such as Canada and Mexico have medium-term gains. In the ‘full-blown’ scenario, GDP effects are much bigger – the worst hit economies including China, some other Asian countries, and the NAFTA economies suffer peak GDP losses of around 2% relative to baseline.

- There are possible downside risks to these estimates. In particular, the US tariff rise in the ‘full-blown’ scenario would be historically large and could provoke broader escalation than we assume. In addition, a stronger dollar and higher US funding costs could have bigger effects on some emerging economies with high debt or weak external positions.

Tags: