Research Briefing

| May 3, 2024

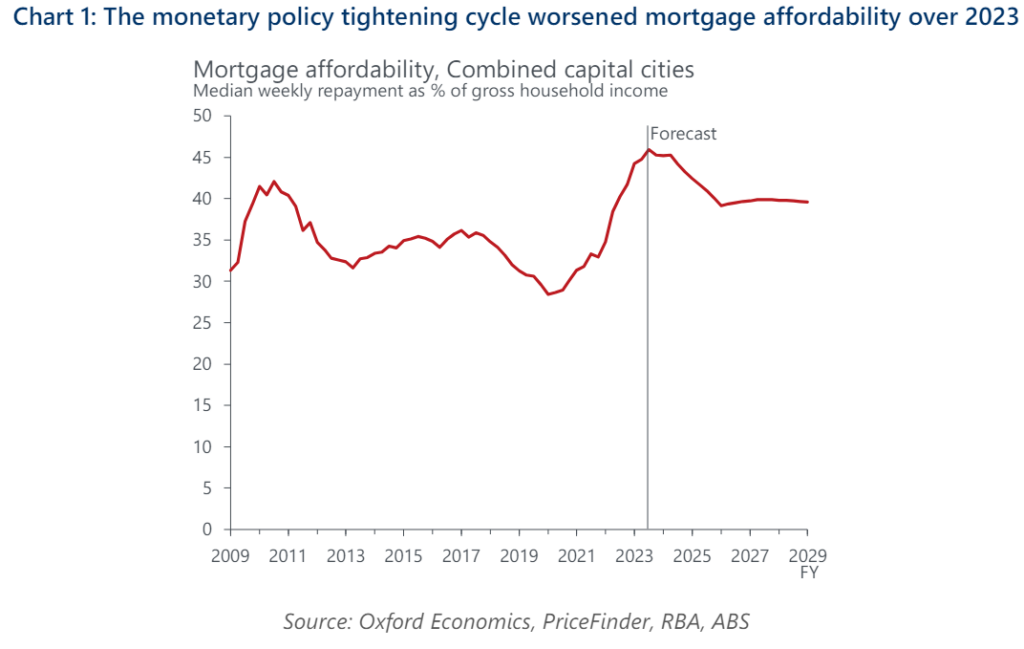

No quick fix for Australian housing affordability

Housing affordability is an active topic in the media and is increasingly part of political discord. Key metrics are running at or near record levels in many markets for renters and mortgage-holders alike. Our revised combined capital city measure of mortgage affordability calculates a record 46% of gross household income is required to service the median all-dwelling purchase moving into 2024. Sydney is the least affordable of the major cities (56%), while Perth is the most affordable (34%). For renters, 28% of average weekly full-time earnings are currently required to service a new rental agreement. Once again, Sydney is the most expensive (33%) with Perth at the other end of the spectrum (25%).

- The supply and demand mismatch for housing has continued to grow; our modelling estimates a significant national dwelling stock deficiency of 110,000, and we project this will increase further. Despite renewed government efforts to boost supply, this chronic shortage of housing is set to entrench affordability woes. It is expected to take until late 2026 before we begin to see the gradual benefits from recent policy actions.

- Forecast cash rate cuts from late this year will provide reprieve for mortgage holders but this is likely to be partially offset by the acceleration of price growth as credit availability improves. However, the deposit hurdle is geared to continue edging higher – a key barrier for first home buyers. Combined capital city rental growth is set to fade to a level more commensurate with income growth over FY2025, improving only slightly thereafter as lower interest rates take some pressure off landlord outgoings.

- The ability of households to absorb increased housing costs is topping out. Nonetheless, cross-market comparisons suggest there is still slack in some cities such as Perth. The relative affordability advantages of such markets is geared to prop up price growth near term.

Tags: