Research Briefing

| Apr 10, 2024

Rate cuts to stoke home prices upwards in 2025 | ResRadar Executive Summary

The combined capital city median all-dwelling price reached $946,000 in December quarter 2023 (+7% y/y). Resilient demand (backed by strong population growth), alongside low listing inventory helped generate competition and price growth. Momentum has been sustained into 2024, with 1.5% q/q growth estimated for Q1.

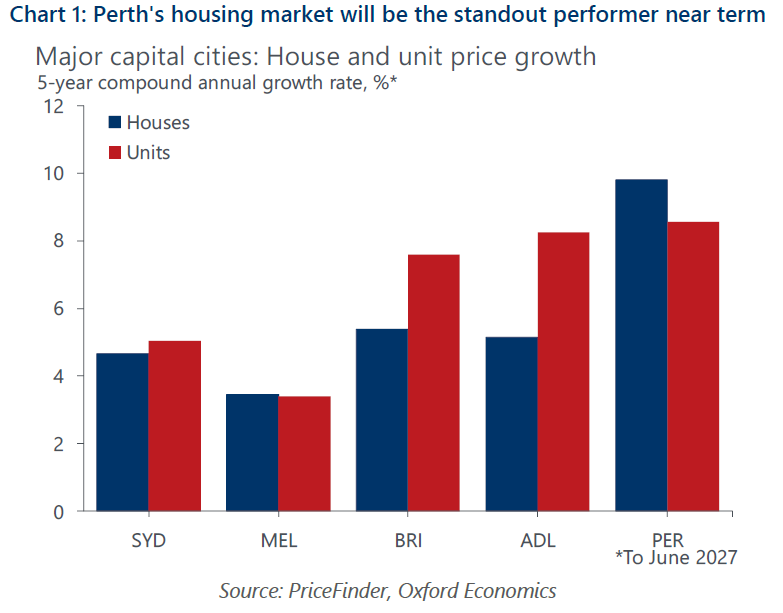

- Interest rate cuts from the end of 2024, compounded by a sustained housing shortage are set to trigger an acceleration in price growth. The median house price is forecast to grow an average 6.2% p.a. over the three years to FY2027. Off a softer run up in recent years, units are expected to outperform, lifting 6.7% annually.

- The current overshoot in net overseas migration is adding heat to an already hot rental market, with the national vacancy rate holding at an extreme low of 1%. Total dwelling rents ended 2023 up 12.9%, with growth skewed towards units (+15.2%). Quarterly growth has eased from its extremes but should nonetheless remain elevated near term. House and unit rents are projected to end 2024 up 6.5% and 8.1% respectively.

- While the rental market is positioned to remain tight, capacity to absorb higher rents is topping out. Simultaneously, easing interest rates over 2025 and 2026 will dial back leveraged investment property costs, softening the impulse from landlords to push large rent increases. In this environment, rental growth is projected to soften to an average of 3.4% over the three years to June 2027 – a rate marginally above core inflation.

Tags: