Research Briefing

| Feb 1, 2024

Stubborn market services inflation to persist in 2024

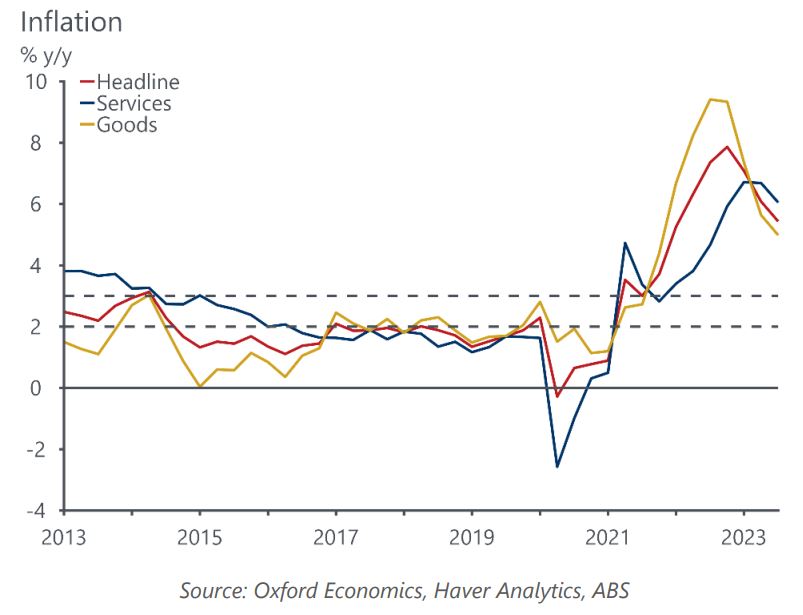

With goods price disinflation now well and truly entrenched, upside risks to the inflation outlook lie with

services components. Services inflation peaked at a lower level than goods inflation, but the upswing was more protracted, with services only starting to decline in y/y terms in Q2 2023.

As RBA Governor Bullock has recently noted, inflation is increasingly homegrown, and demand driven. Services inflation is now the main upside risk of interest. Consumer services tend to be non-tradeable, making them less exposed to global price shocks and international competition. When demand outstrips domestic supply, prices are quite responsive as imported substitutes are less readily available, if at all.

What you will learn:

- Services inflation is primarily being driven by market services, where a combination of cost pressures and strong demand continue to drive inflation. Looking through a recent surge in travel and accommodation prices, the runup in market services inflation was more benign, but likely has further to run.

- The services inflation cycle has lagged that of goods. While upside risks to services inflation remain due to the brisk pace of unit labour costs, it does appear to now be on the downswing. Inflation in non-market components has been well contained in part due to government efforts to limit cost-of-living pressures. However, there will be some payback as these policies roll off.

- Inflation will slow in 2024; the key questions that remain for policy makers are how fast the disinflation will be, and whether policy settings are tight enough to ensure inflation returns to the RBA’s target. Much of the uncertainty around the outlook lies with the path for services.

Tags: