Research Briefing

| May 20, 2024

Surprisingly big spending budget ratchets RBA pressure

The Budget is more stimulatory than we had anticipated and presents some upside risk to an otherwise modest growth outlook in FY25. We had already bolstered our outlook a little following the redesign of the tax schedule. But the untargeted energy bill relief, expansion of rent assistance and student debt relief will all work to boost household incomes.

Access the property to learn more about our key pointst:

- The 2024 Budget’s policy changes broadly fall into four categories: cost of living relief, tax cuts, the Future made in Australia policy and core public services – particularly health and defence. In total policy changes in this Budget deliver $11.7bn in stimulus in FY25.

- Growth in real spending has been revised materially higher in the next two years; from 2.9% to 5.5%. This is before a marked expansion in ‘off budget’ spending is considered. With the RBA still trying to cool the economy – and likely to have rates in restrictive territory for quite some time yet – Australia seems to be moving back to having the two main levers of policy working at odds with each other.

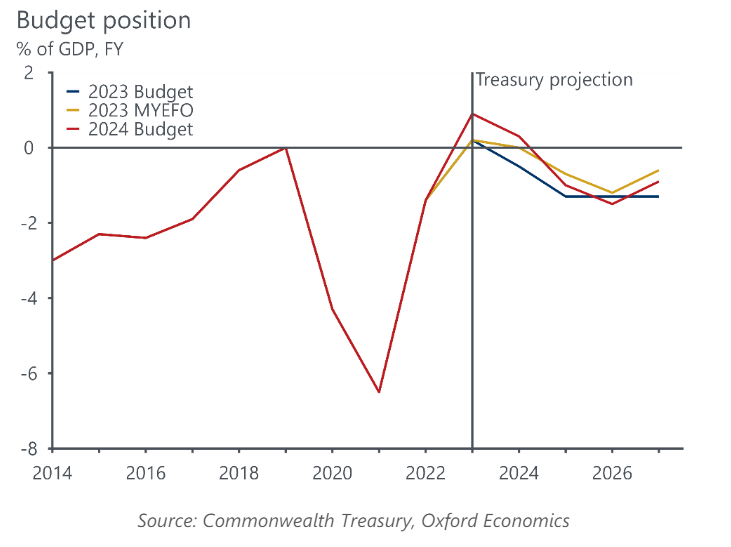

- Another upside surprise to revenues has pushed the Treasury’s projection for the budget balance back into surplus in FY24. Income tax has outpaced expectations due to strong wage and labour force growth, while company tax receipts have been again bolstered by better-than-expected terms of trade.

Tags: