Research Briefing

| May 3, 2024

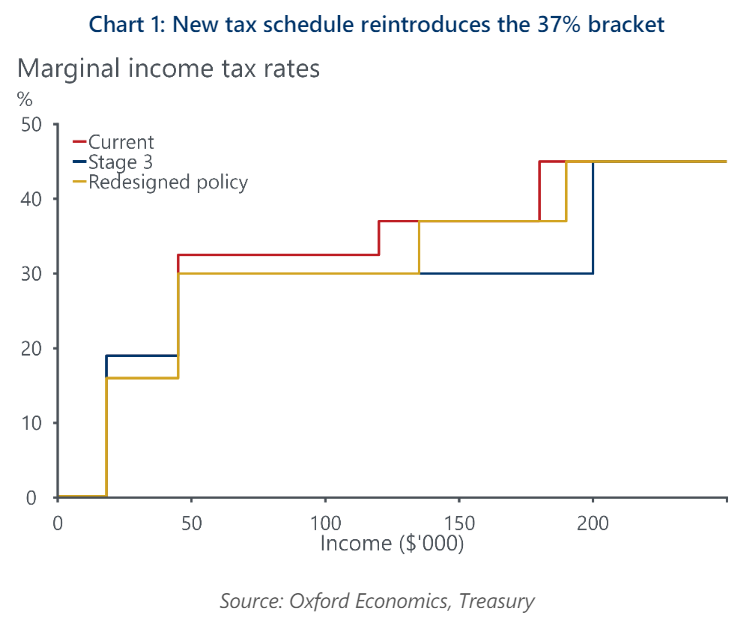

Tax cuts for all as stage three is dumped

The Albanese government announced a significant restructure of the personal income tax schedule. The stage three tax cuts legislated in 2019 and due to come into effect on 1 July will be overhauled in favour of a more progressive schedule. The redesigned system will be budget neutral relative to the stage three changes, meaning that the large tax cuts due to come into effect for high income taxpayers will now be redistributed into smaller cuts for all taxpayers.

- These changes will only go some of the way to redressing the recent surge in income tax as a share of household income. This ratio has been driven to a historically high level by inflation and bracket creep over the past three years.

- While the budget bottom line may be unchanged, relative to stage three the redesigned system will have a larger multiplier effect as it distributes income toward those with a higher marginal propensity to consume. Accordingly, these changes present some upside to the outlook for FY25. The Treasury expects the changes will not materially impact the outlook for inflation. This seems an optimistic outlook, and we think these changes may prolong the wait for the first RBA rate cut.

Tags: